In the previous parts of this series pertaining to ringgit realignment, we have discussed the importance of interest rates, current account surplus, and portfolio flows on the ringgit’s valuation. This final part of the series will discuss the supply of money which plays an integral role in the long-term standing of the ringgit.

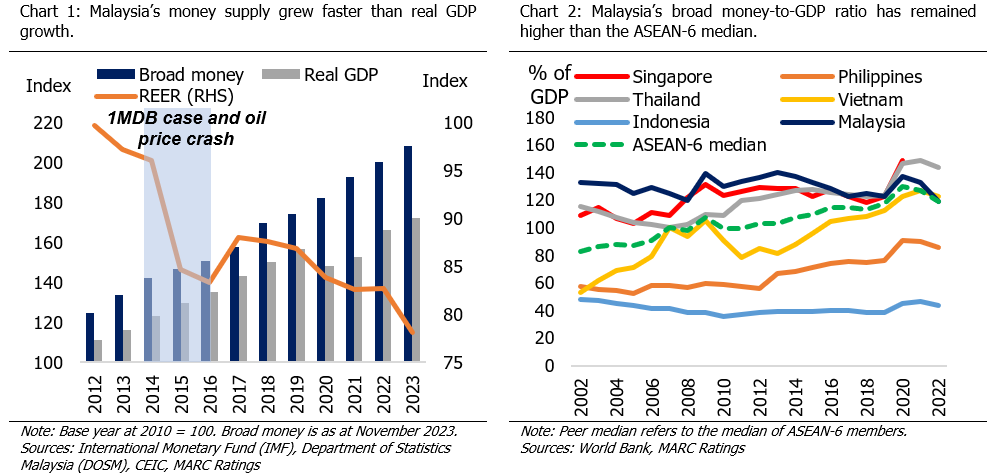

The price of money is influenced by its supply, hence, a stable currency with appropriate money supply growth requires well-managed debt levels and a healthy fiscal position. Over the past decade (2012–2022), Malaysia’s broad money had been growing by 4.9% per annum and exceeded the nation’s real economic growth rate of 4.1%. Additionally, Malaysia’s 10-year average (2013–2022) broad money-to-GDP ratio was 129.8%, higher than the ASEAN-6 median of 10-year averages of 117.3%.

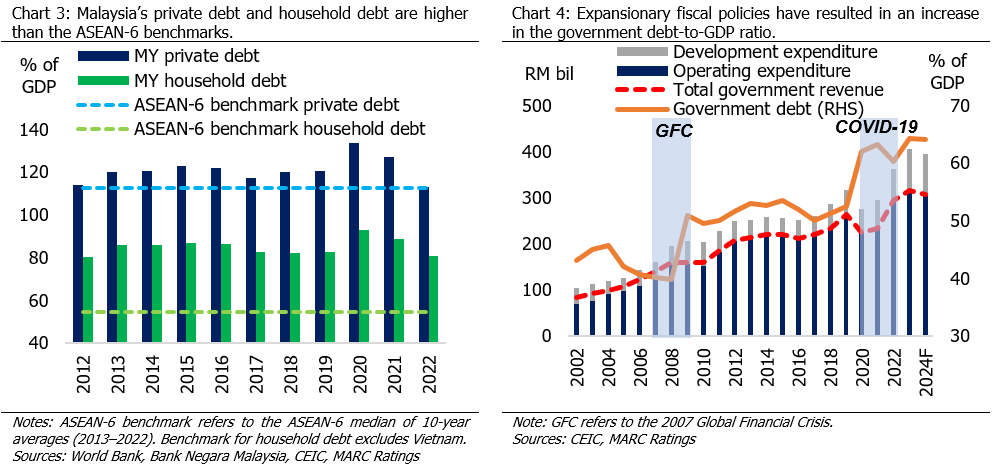

Malaysia’s low interest rate environment, as discussed in part one of this ringgit series, has likely contributed to a preference for borrowing and credit creation, which subsequently increased the money supply. From 2013 to 2022, Malaysia’s private debt-to-GDP ratio had been relatively high, averaging 121.8% against the ASEAN-6 median of 10-year averages of 112.4%. This may partly be attributed to Malaysia’s significantly higher household debt of 85.6% during this period, against the ASEAN-6 median of 54.4%. While Malaysia has a resilient financial system, encouraging savings instead of borrowings may contain excess credit creation and improve capital availability for future investments.

Low interest rates are positively correlated with money supply growth and the government’s expansionary fiscal policies. Persistent fiscal deficits and missed targets (as discussed in our previous article) have led to Malaysia’s government debt-to-GDP ratio reaching close to the statutory debt limit of 65% (2023: 64.3%). High public debt levels raise the perceived country risk, leading to portfolio outflows and a weaker ringgit.

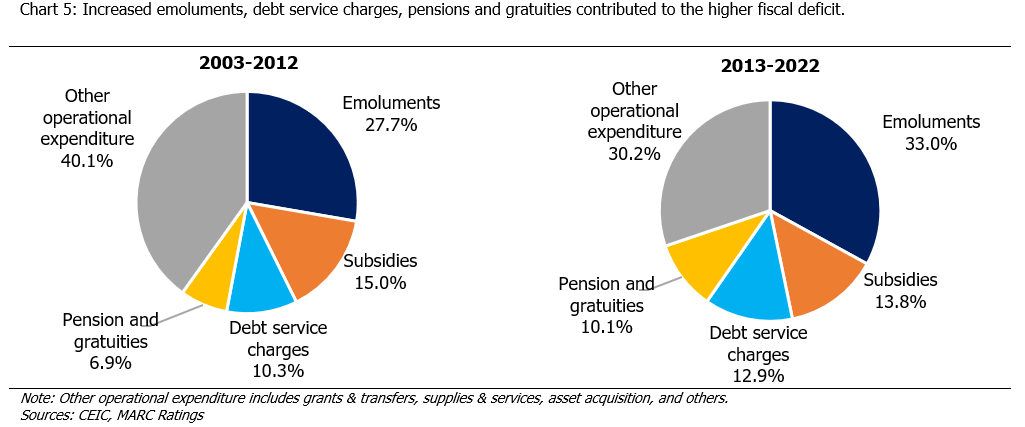

In addition, fiscal expenditures need to be allocated for capacity building rather than current expenses. Of note, development expenditure as a percentage of total government expenditure in the past decade (2013–2022) decreased to 17.5% compared to that of the previous decade (2003–2012) of 22.8%. During the same period, in terms of operational expenditures, the share of emoluments experienced the largest increment, from 27.7% to 33.0%; followed by pensions and gratuities (from 6.9% to 10.1%); and debt service charges (from 10.3% to 12.9%). Furthermore, the government’s plans of hiking civil servants’ salaries may hamper fiscal consolidation efforts. Therefore, further actions are required to improve tax revenue and reduce the deficit, which would limit indebtedness and money supply growth as well as improve the ringgit.

Throughout this multi-part series, we discussed that the combination of global trends alongside domestic fiscal and monetary policies can influence fluctuations in the ringgit. Utilising a multi-pronged policy approach focused on interest rates, portfolio flows, current account balance, fiscal balance and money supply would complement the country’s efforts in pursuing the desired ringgit pathway.

This press announcement is the fourth and final in a multi-part series discussing our opinions over the ringgit’s pathway and accompanying adjustments that can potentially be made to better align the value of the ringgit, such that it reflects Malaysia’s solid fundamentals.