In the upcoming Monetary Policy Committee (MPC) meeting on March 3, 2022, we foresee that Bank Negara Malaysia (BNM) will hold the overnight policy rate (OPR) unchanged at the historical low of 1.75%. We envisage BNM will express its cautious stance while maintaining its assessment of the economy and inflation outlook. BNM has been in this status quo since July 2020 to support the economy's fragile recovery.

The Malaysian economy does not appear to be ready for monetary normalisation amid the absence of any signs of solid demand-side recovery. Real GDP growth in 4Q2021 came in at 3.6% y-o-y (3Q2021: -4.5%), primarily driven by the easing of the supply side. The rebound could have been higher but was mired by sluggish demand as well as low public and private sector investments. Furthermore, the downside risks to growth remain significant amid heightened uncertainties associated with the pandemic response and geopolitical tensions ramping up.

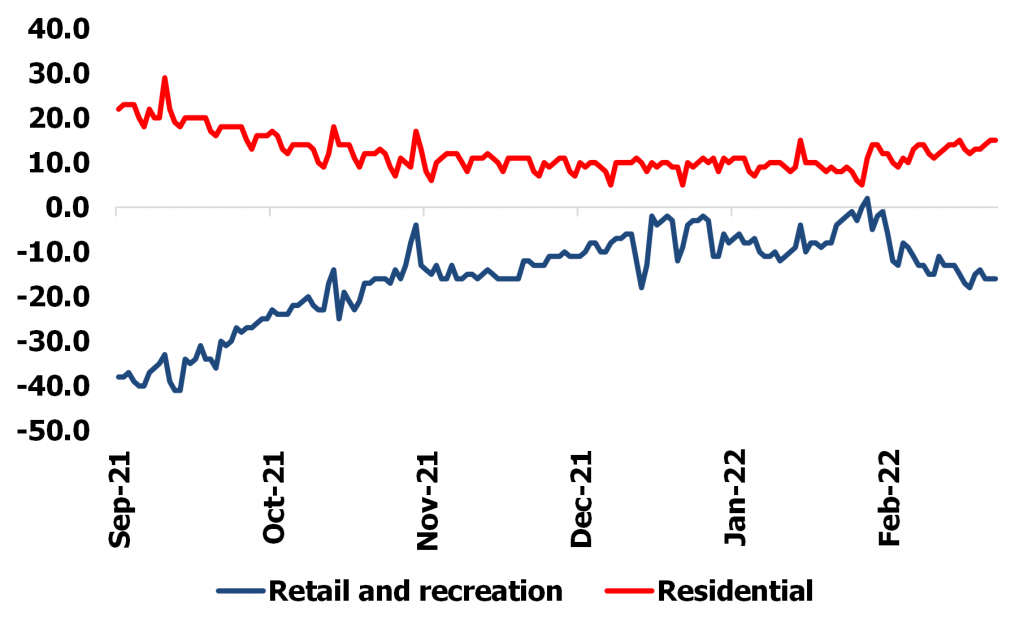

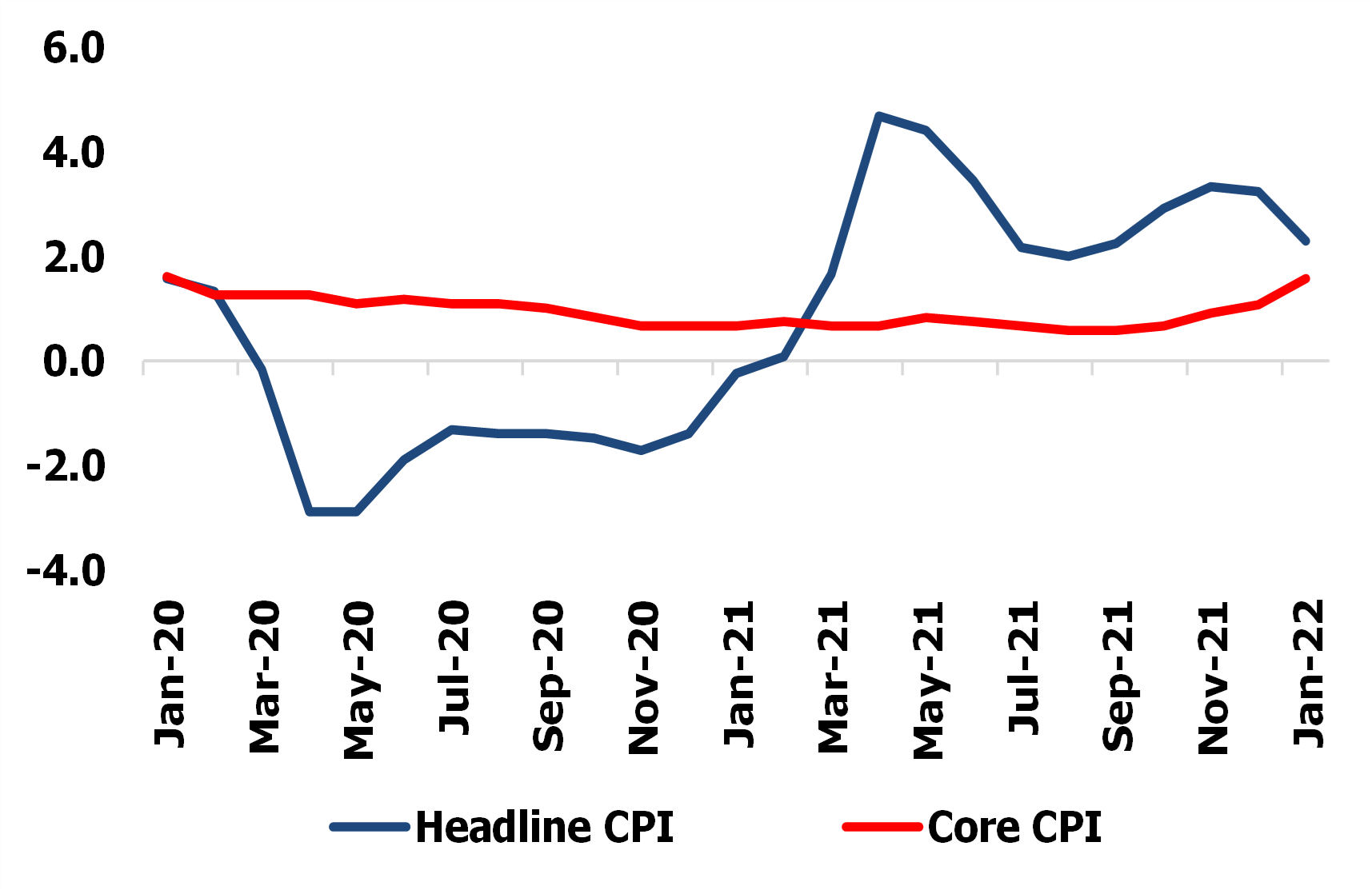

The government has lifted much of the supply restrictions in line with the National Recovery Plan but high-frequency data of late suggests that demand recovery is not automatic. As the number of COVID-19 cases has skyrocketed since February, consumers appear to exercise "voluntary lockdown" by refraining from making retail purchases and preferring to work/stay-at-home, as evident in recent Google Mobility data. Suffice to say that this will surely thwart demand recovery in the coming weeks or even months.

The build-up of financial vulnerabilities from the extended period of historically low interest rate has been well contained thus far. The latest available data showed that the house price index (HPI) grew at the slowest pace in more than a decade in 3Q2021. Meanwhile, loan growth returned to pre-pandemic levels in 2021, but a sharp spike in the coming months is unlikely. Loan growth rose only marginally to 4.5% in December 2021 from 4.3% in the previous month. As such, it is compelling for BNM to retain its accommodative monetary settings for some time.

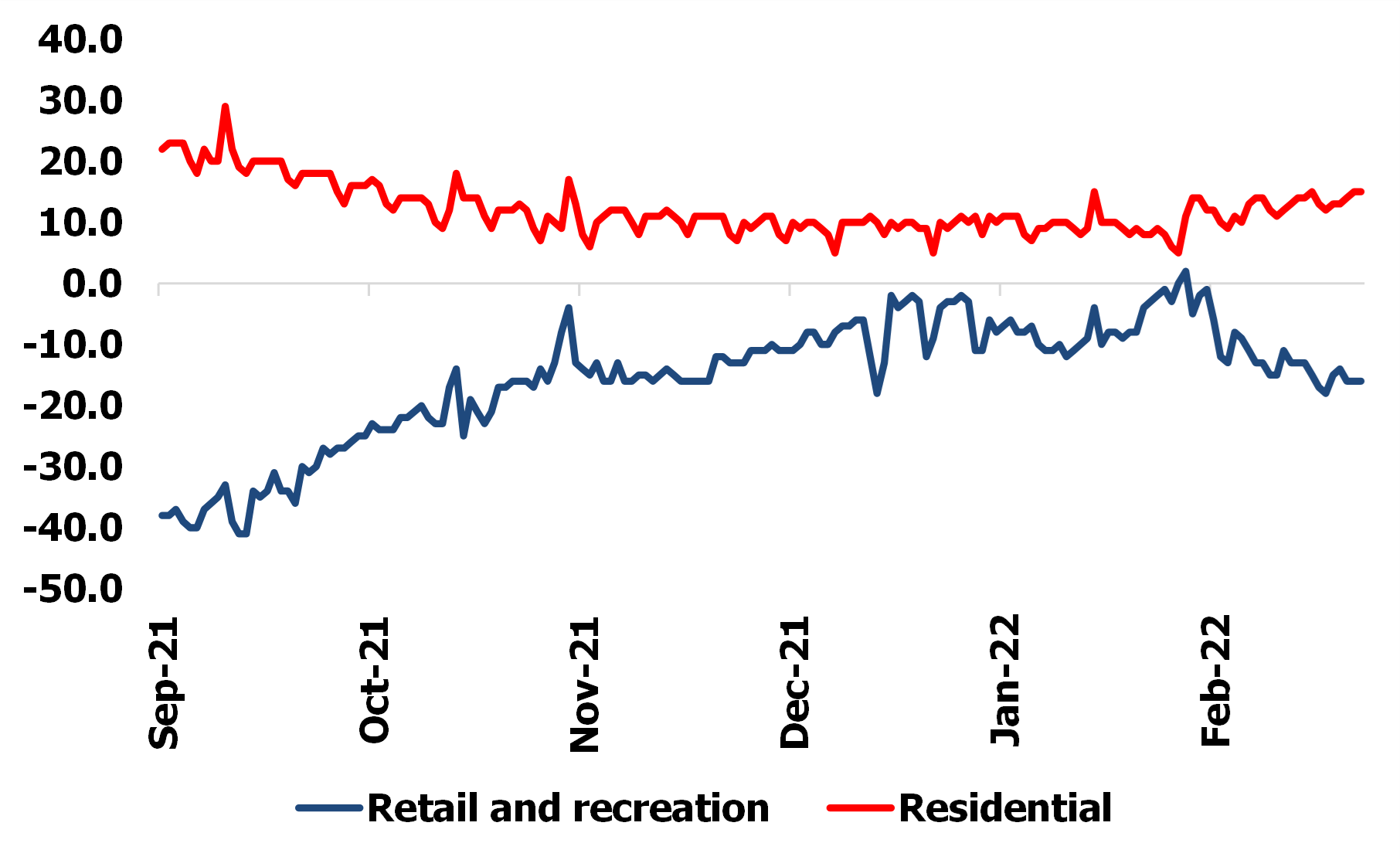

Inflation is most likely expected to remain modest. In January 2022, headline inflation fell to 2.3% from 3.2% in the previous month, while core inflation was pushed up but remained below the 2% target at 1.6%. We believe inflationary pressures will remain cost-push for now, mostly coming from food and non-alcoholic beverages, which constitute more than a quarter of the core inflation basket. We see further upside inflationary risks from higher commodity prices and a weaker ringgit due to the Russia-Ukraine war to only persist in the near term and would be restricted by the continued slack in demand. As such, we expect the government to resort to short-term policy moves by suppressing rising prices via subsidies and other price control mechanisms.

We believe that the National Recovery Council's proposal to reopen Malaysia's borders is a positive development. For this to work, a wholesale SOP revision must take place to improve consumer confidence.

That said, we opine that a higher interest rate would only be possible with a drastic change in the external environment or a speedier pace of pass-through amid rising input costs. Abrupt changes in the monetary policy are unlikely, and the monetary settings will remain sufficiently accommodative for some time. Otherwise, based on available data, we maintain our view that BNM's lift-off would only occur during 2H2022, and the quantum of rate increases would be gradual.

Chart 1: Google mobility (%) Chart 2: Consumer price index (CPI) (% year-on-year)

Sources: Google LLC, MARC Ratings Sources: Department of Statistics Malaysia, MARC Ratings

Contacts:

Firdaos Rosli, +603-2717 2936/ firdaos@marc.com.my

Lee Si Xin, +603-2717 2942/ sixin@marc.com.my