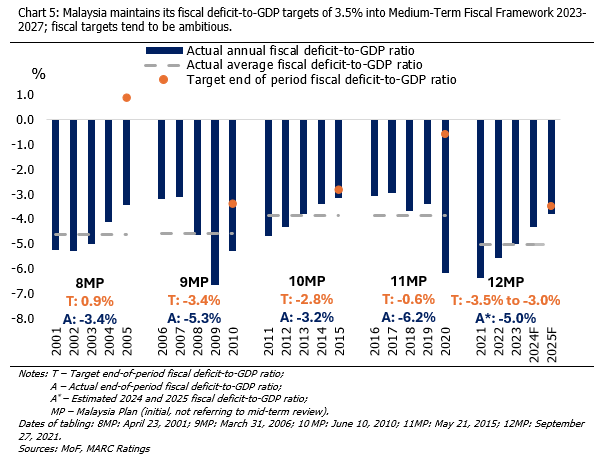

On October 18, 2024, the Malaysian government announced an allocation of RM421.0 billion for Budget 2025, marking a 3.3% increase from the previous year (2024: 1.5%). Of this amount, RM335.0 billion is designated for operating expenditure (2024: RM321.5 billion) while the allocation for development expenditure remains at RM86.0 billion (2024: RM86.0 billion). Budget 2025 underscores the Madani government’s commitment to driving economic growth while ensuring fiscal consolidation, targeting a reduction in the fiscal deficit from 4.3% in 2024 to 3.8% in 2025.

In recent years, key reforms to various food, fuel and electricity subsidies have been put in place, the outcome of which has been reflected by a decline in subsidies and social assistance expenditures. These reforms indicate a shift towards the partial retargeting of subsidies, with savings channelled to welfare assistance programmes for vulnerable groups. While the government aims to further streamline the key fuel subsidy, RON95 petrol by mid-2025, it is unlikely that petrol prices will fully reflect market rates in the short term. In this respect, the majority of Malaysians are expected to continue benefitting from some form of subsidy. Based on the implementation of the diesel subsidy reforms in 2024, increased cash transfers will cushion the impact of rising fuel prices on the public, reinforcing the government’s incremental approach to subsidy reform. Effective policy sequencing will be crucial to ensure these reforms are successfully executed.

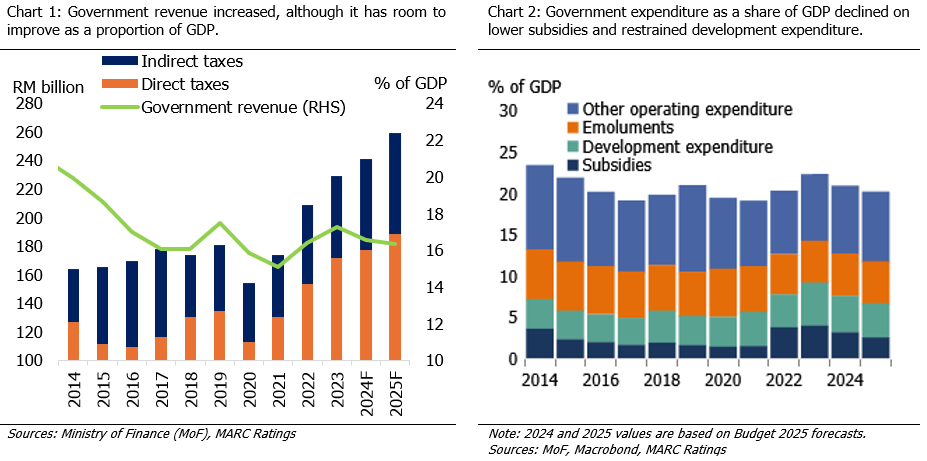

The government has made proportionate adjustments between operating expenditure and development expenditure. While operating expenditure continues to rise, development expenditure as a share of gross domestic product (GDP) is projected to decline slightly in 2025 compared to its increase in 2024, although this would remain above the threshold of 3% of GDP as described in the Public Finance and Fiscal Responsibility Act 2023. To address development funding needs, government-linked investment companies are expected to partner with the government in financing efforts, leveraging their financial capacity to support national development. In this regard, the Public-Private Partnership Master Plan 2030 will serve as a key framework for enhancing collaborations with the private sector.

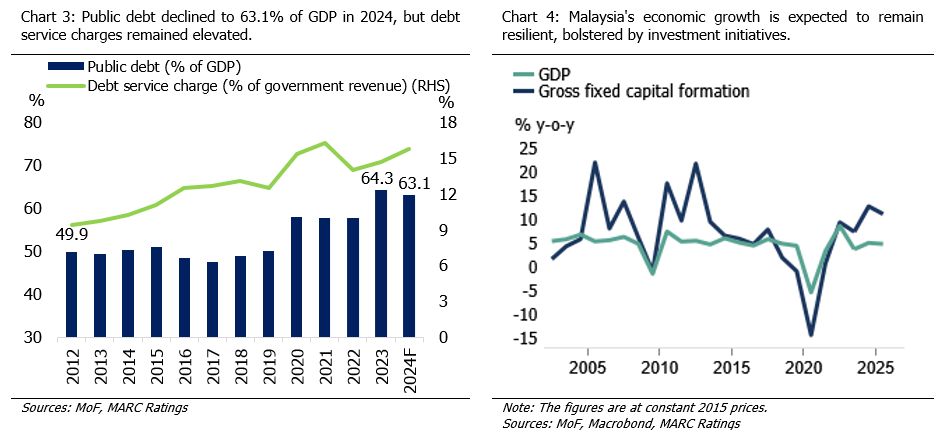

Increasing government revenue is essential for reducing the fiscal deficit, particularly given the lower-than-benchmark tax collection discussed in the prior press release. Overall, government revenue is projected to rise by 5.5% to approximately RM339.7 billion in 2025, outpacing expenditure growth. To enhance government revenue and reduce reliance on petroleum-related income, the implementation of the Global Minimum Tax for multinationals has been reaffirmed in Budget 2025 while a carbon tax targeting the iron, steel, and energy sectors will be introduced in 2026, further diversifying tax revenue. As such, corporate tax income is projected to rise by 8.1% in 2025, improving from 7.4% in 2024.

The theme of tax policy remains progressive. A 2% tax on dividend income of over RM100,000 was announced in Budget 2025. Additionally, the government expanded the scope of the Sales and Services Tax (SST) to include imported premium goods and fee-based financial services; other items will be added progressively. Nonetheless, SST is expected to grow by just 14.2% in 2025 compared to 15.4% in 2024. Expanding the scope of SST remains pertinent in the absence of a broad-based consumption tax such as the Goods and Services Tax.

Key initiatives from national master plans that supported economic growth in 2024 will continue to drive progress in 2025. Private investments are expected to stay strong, with a projected growth rate of 8.9% in 2025 (2024 forecast: 11.1%). To sustain this momentum, a New Investment Incentive Framework aimed at high-growth high-value sectors has been introduced in Budget 2025, aligning with national master plans. This framework includes new tax incentives and matching funds tailored to state-specific strategies, along with allocations for technical training to address sectoral talent needs. Continued investment in strategic infrastructure is also anticipated to enhance the country’s productivity.

Budget 2025 places significant emphasis on the green economy, including the strengthening of food security through sustainable agricultural innovation and enhancing collaboration between industry stakeholders and government agencies. Additionally, several concrete measures were outlined to support energy transition goals, including increased budget allocations and initiatives such as the development of solar farms and green hydrogen hubs, and tax incentives for Carbon Capture, Utilisation, and Storage activities.

Overall, we commend the government’s efforts to advance the nation’s reform agenda, which aims to further consolidate fiscal stability and increase Malaysia’s competitiveness through consistent policy implementation across all master plans. As 2025 marks the final year of the 12th Malaysia Plan, Budget 2025 sets a solid foundation to achieve growth of between 4.5% and 5.5%, providing a strong foundation for the upcoming 13th Malaysia Plan.