We opine that Malaysia’s real gross domestic product (GDP) growth will likely pick up strongly by 8.5% y-o-y in 2Q2022, compared with the 5.0% recorded in 1Q2022. Our upbeat assessment is premised on the ongoing strength in private consumption growth, as suggested by high-frequency indicators despite a substantial uptick in imports.

Private consumption will remain the mainstay of growth in 2Q2022. Retail sales are anticipated to record a double-digit y-o-y growth (1Q2022: 9.4%) given the return of footfall to the pre-pandemic level, thanks to the full resumption of economic activities and the reopening of international borders. Household spending was bolstered by festive celebrations and the fourth round of withdrawals from the Employees Provident Fund (EPF). Given the steadily declining unemployment rate (2Q2022: 3.9%; 1Q2022: 4.1%), conditions have been favourable for households despite rising inflationary pressures.

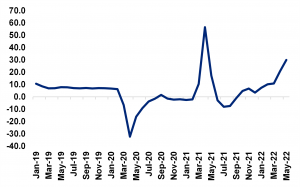

In line with the rising consumption, the industrial production index (IPI) grew by an average of 6.9% y-o-y in 2Q2022, somewhat stronger than the 4.5% recorded in 1Q2022. In addition, the Manufacturing Purchasing Managers’ Index (PMI) has remained in the expansion territory since April amid new solid orders. This was aided by healthy external demand, with exports expanding by an average of 30.0% y-o-y, up from 21.8% in 1Q2022.

We expect import growth to continue to outpace exports, resulting in negative net exports. Imports surged an average of 36.2% in 2Q2022, accelerating from 24.9% in 1Q2022. Having said that, this scenario was likely less significant as exports remained supported by the upturn in global electronics demand and the higher commodity prices.

Looking forward, consumption should continue to support growth in the coming quarter. Still, the momentum will slowly recede as households adjust their spending in response to higher inflation and rising interest rates. The strong 2Q2022 GDP print will likely provide some comfort to Bank Negara Malaysia to resume its rate hike path. We opine that policy normalisation will proceed with two rate hikes in September and November this year.

Source: CEIC Data

Chart 2: Malaysia retail trade (% y-o-y)

Sources: Department of Statistics (DOSM), CEIC Data