Malaysia's GDP in 3Q2020 signals the country's path towards economic recovery. While the resumption of economic activities has enabled some level of normalisation, the recent spike in COVID-19 infections and the imposition of lockdowns in a majority of states could dampen Malaysia's economic growth trajectory in the immediate term. Following the unveiling of Budget 2021 last week, we believe that Malaysia's recovery will be incremental as new waves of COVID-19 infections occur domestically and externally. As such, we believe that economic recovery in the coming quarters will depend on the following trends:

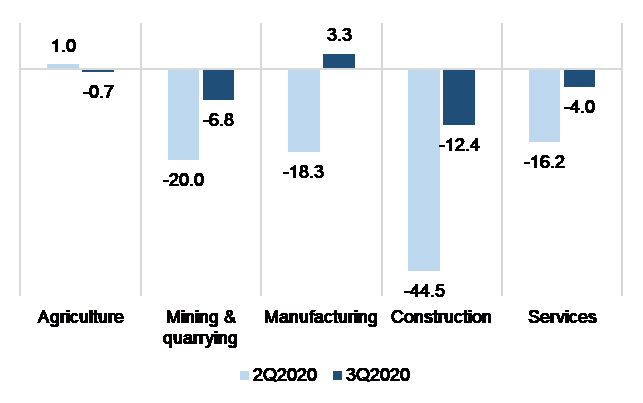

- The worst is over for 2020, but the scarring effects of the public health and economic crisis remain. Malaysia's 3Q2020 GDP growth print confirms that the economy has entered a technical recession, although at a much slower contractionary pace of 2.7% y-o-y (2Q2020: -17.1%). This is better-than-expected, due to improved industrial production, external demand and COVID-19-related stimulus measures.

A similar trend was seen in other regional economies, namely Singapore (3Q2020: -7.0%; 2Q2020: -13.3%), the Philippines (3Q2020: -11.5%; 2Q2020: -16.9%) and Indonesia (3Q2020: -3.5%, 2Q2020: -5.3%).

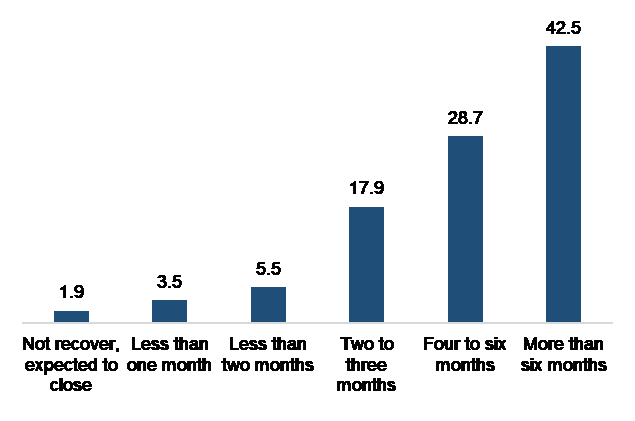

Malaysian businesses continue to show great resilience in weathering the downturn. According to a DOSM survey, only 1.9% of firms surveyed indicated that they face impending closure, while 42.5% said they are able to survive for more than six months.

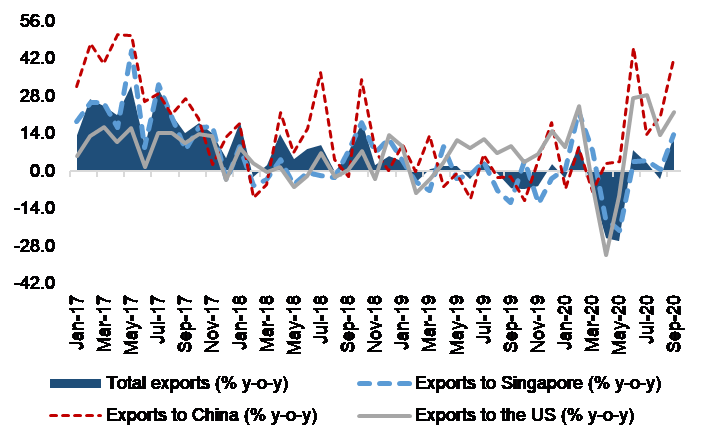

In 3Q2020, Malaysia's Industrial Production Index grew 0.8% y-o-y (2Q2020: -18.0%), driven by the 3.1% uptick in the manufacturing index. This was due to the recovery in external demand, evidenced by exports expanding by 4.6% y-o-y, up from -14.3% in the previous quarter. Unsurprisingly, manufacturing sales have also picked up to pre-COVID-19 levels, after collapsing in April and May. In 3Q2020, it rose 2.4% y-o-y from the previous quarter's -16.4%.

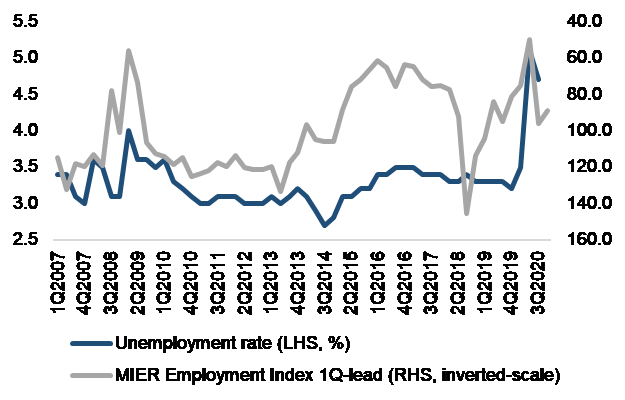

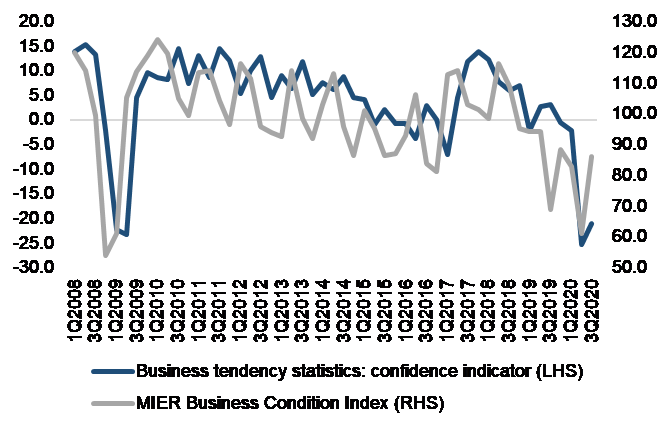

Notwithstanding this, the scarring effects of the sharp downturn in 2Q2020 continue to manifest. Business confidence across all sectors remains very low (3Q2020: -21.0%; 2Q2020: -25.2%), and the unemployment rate (3Q2020: 4.7%, 2Q2020: 5.1%) is still higher than pre-MCO levels. We expect downside risks to predominate 4Q2020 growth prospects due to the resurgence in COVID-19 infections both domestically and externally, as well as a wider implementation of the Conditional MCO (CMCO) in Malaysia.

- We opine that the Malaysian economy is expected to moderate in the next two quarters. Undoubtedly, economic recovery will be primarily contingent on the complete cessation of the MCO and freer cross-border movements. We believe that the Malaysian economy will trend sideways in the coming months given that CMCOs are being deployed in a majority of states while international borders remain closed.

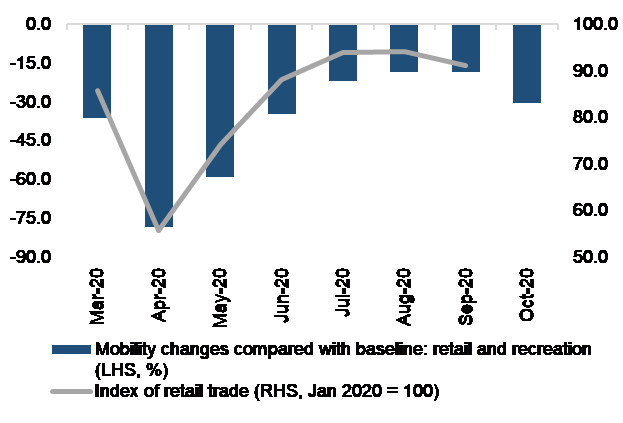

There is hope for a recovery in domestic demand during the CMCO period, although prospects remain somewhat muted. Retail footfall appears to be in a downward trend since October 2020 despite considerable improvements over the preceding quarter, suggesting a shift towards online purchases.

Loan applications jumped in June 2020, i.e. during the Recovery MCO period, but it continues to trend below pre-COVID-19 levels. We believe that this uptrend may not be sustained in the immediate term due to the challenging labour market conditions. After all, wage growth, which had already been stunted even before the pandemic, has been significantly impacted by the health and economic crisis. It comes as no surprise that according to the results of MIER's latest Consumer Sentiments Survey report, consumers continue to lack confidence over their economic well-being.

We are cautiously optimistic with the recent news reports about the success of Pfizer's vaccine trial. Although this is a very encouraging development, mass rollouts of the vaccine, which will need regulatory approval, are not expected anytime soon. The fact that the vaccine must be stored at an extremely cold temperature (-70 degrees Celsius or below) will raise concerns about its viability for a tropical country such as Malaysia.

The Malaysian economy continues to run below its long-term growth trajectory capacity as the current wave of infections and widening of CMCO have hampered prospects of recovery for the remainder of the year. If the current scenario of triple-digit daily infections continues for much longer, it could be quite some time before domestic demand returns as an economic growth driver. In any case, our full-year GDP forecast for 2020 currently stands at between -4.5% and -5.5%, before rebounding to between 6.3% and 6.7% in 2021.

- Rebound by major trading partners will aid Malaysia's recovery in 2021. Net exports played a critical role in improving Malaysia's 3Q2020 growth performance. Malaysia's exports to China, Singapore and the US have improved following the resumption of economic activities since 2Q2020. We believe that external demand will remain upbeat in the coming months as virus infections in China and Singapore appear to be under control.

However, we take note that the rise in exports, and subsequently trade surplus, is largely due to the slowdown in imports of intermediate goods. Assuming that external demand remains constant, we believe that imports will rise considerably in order to cater for orders in the coming months. While this may put a drag on Malaysia's net exports, its total trade will move in tandem with the positive external demand. We believe that such an adjustment period will normalise in 1Q2021. In any case, there are concerns that the current growth support for the Malaysian economy stemming from external demand could only fizzle out in the face of stricter lockdowns in major advanced economies.

Appendix

| Chart 1: Real GDP growth (% y-o-y) by industry | Chart 2: Estimated period for companies/business firms to recover |

|

|

|

|

| Source: Department of Statistics Malaysia (DOSM) | Source: DOSM’s Special Survey ‘Effects of COVID-19 on the Economy and Companies/Business Firms’ – Round 1 | |

| Chart 3: Labour market conditions |

Chart 4: Retail footfall and retail sales |

|

|

|

|

| Sources: DOSM, MIER, CEIC | Sources: Google’s COVID-19 Community Mobility Report, CEIC, MARC ERD | |

| Chart 5: Business confidence | Chart 6: Export performance | |

|

|

|

| Sources: DOSM, MIER, CEIC | Sources: DOSM, CEIC, MARC ERD |

Contacts:

Firdaos Rosli, +603-2717 2936/ firdaos@marc.com.my;

Quah Boon Huat, +603-2717 2931/ boonhuat@marc.com.my;

Lee Si Xin, +603-2717 2942/ sixin@marc.com.my.