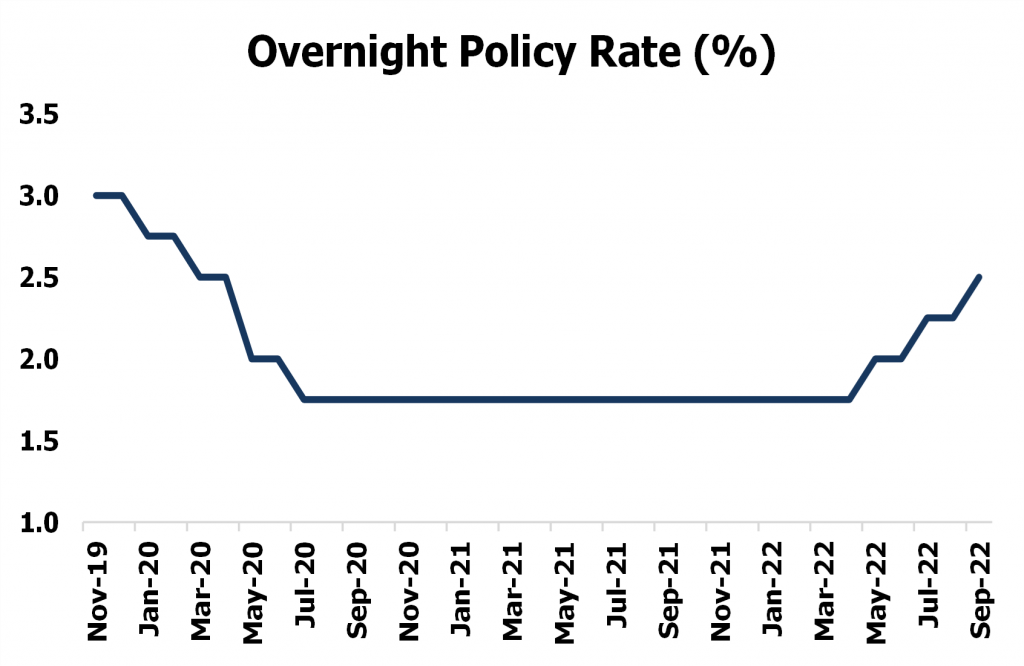

Today, Bank Negara Malaysia (BNM) announced its Monetary Policy Committee's (MPC) decision to increase the overnight policy rate (OPR) by 25 basis points to 2.50%.

The hike, the third in as many MPC meetings, further rolls back part of the monetary support implemented during the worst of the COVID-19 crisis. After the pandemic emerged in early 2020, the MPC had cut the OPR by a cumulative total of 125 basis points from the pre-pandemic level of 3.00%.

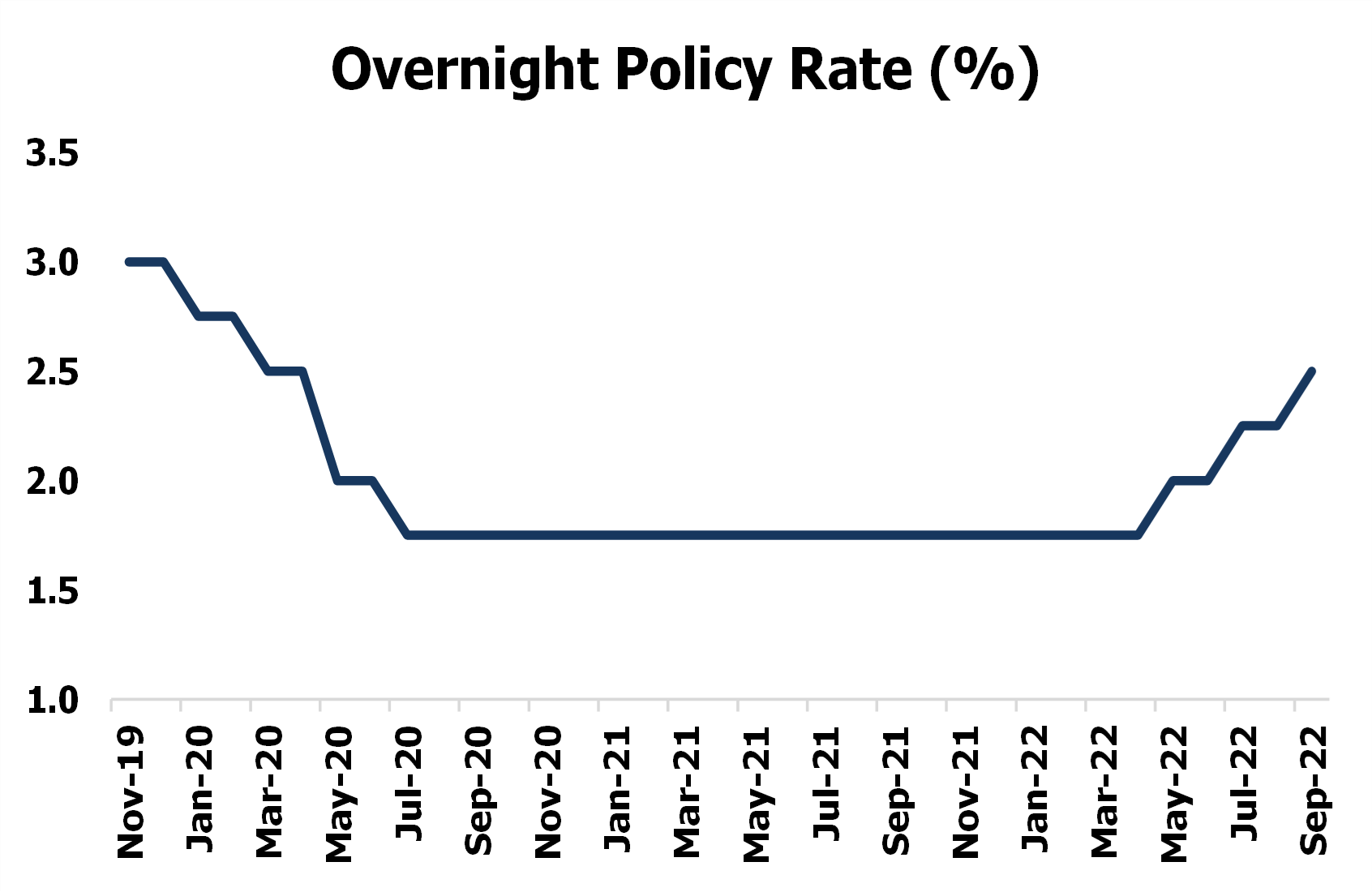

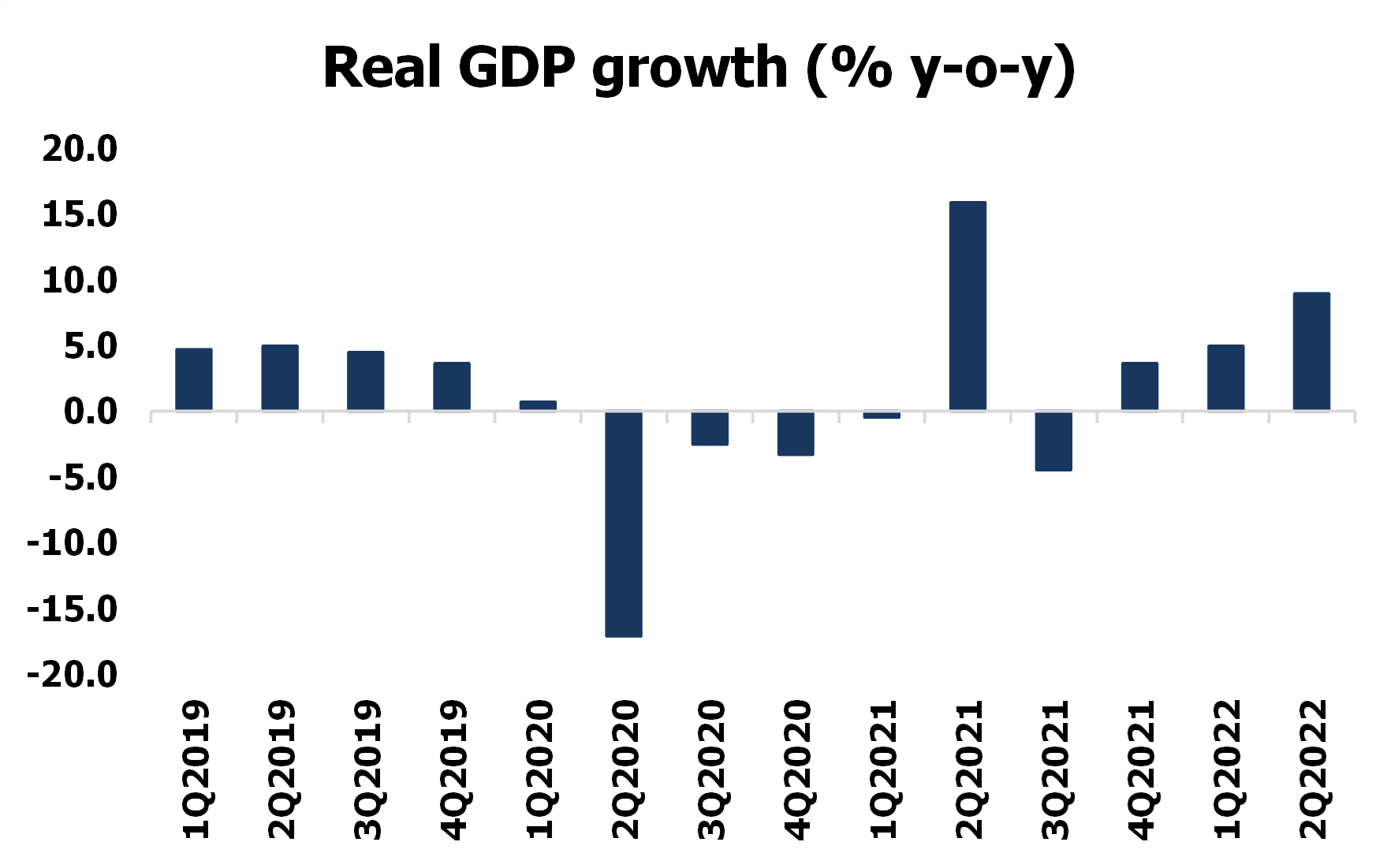

The MPC's latest move comes as no surprise given the significant surge in Malaysia's 2Q2022 gross domestic product (GDP) growth pace to 8.9% (1Q2022: 5.0%). With this, GDP growth pace in 1H2022 stood at 6.9%, just a hair's breadth lower than the 7.0% achieved in the same period last year.

With domestic demand expected to remain firm on the back of, among other things, an improving labour market, we are upgrading our full year 2022 GDP growth forecast to 6.5% (2021: 3.1%) from 5.5% previously. Our upgraded forecast remains in line with the central bank's forecast range of 5.3%–6.3%.

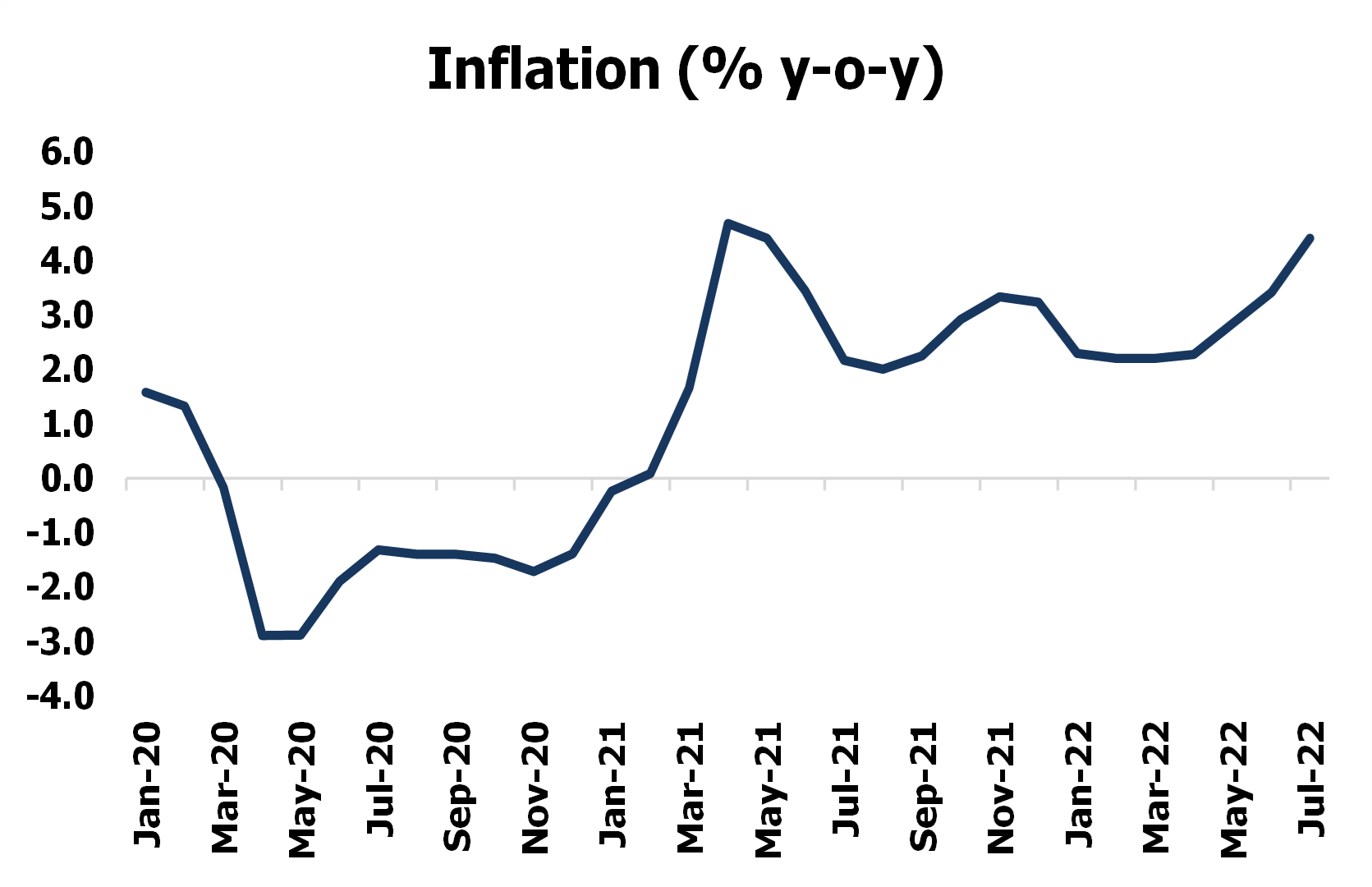

We expect the demand-pull side of the inflation equation, given the improving domestic growth outlook, to manifest itself stronger going forward. On the external front, we see the Ukraine-Russia conflict, which has triggered particularly severe disruptions to global markets for critical raw materials, and worsening drought conditions continuing to contribute towards global inflationary pressures.

We have, as such, revised our 2022 inflation forecast upwards to 3.3% from 2.7% previously. This is slightly above BNM's forecast range of 2.2%–3.2%. According to the MPC in its Monetary Policy Statement, it expects inflation to peak in 3Q2022 before moderating thereafter.

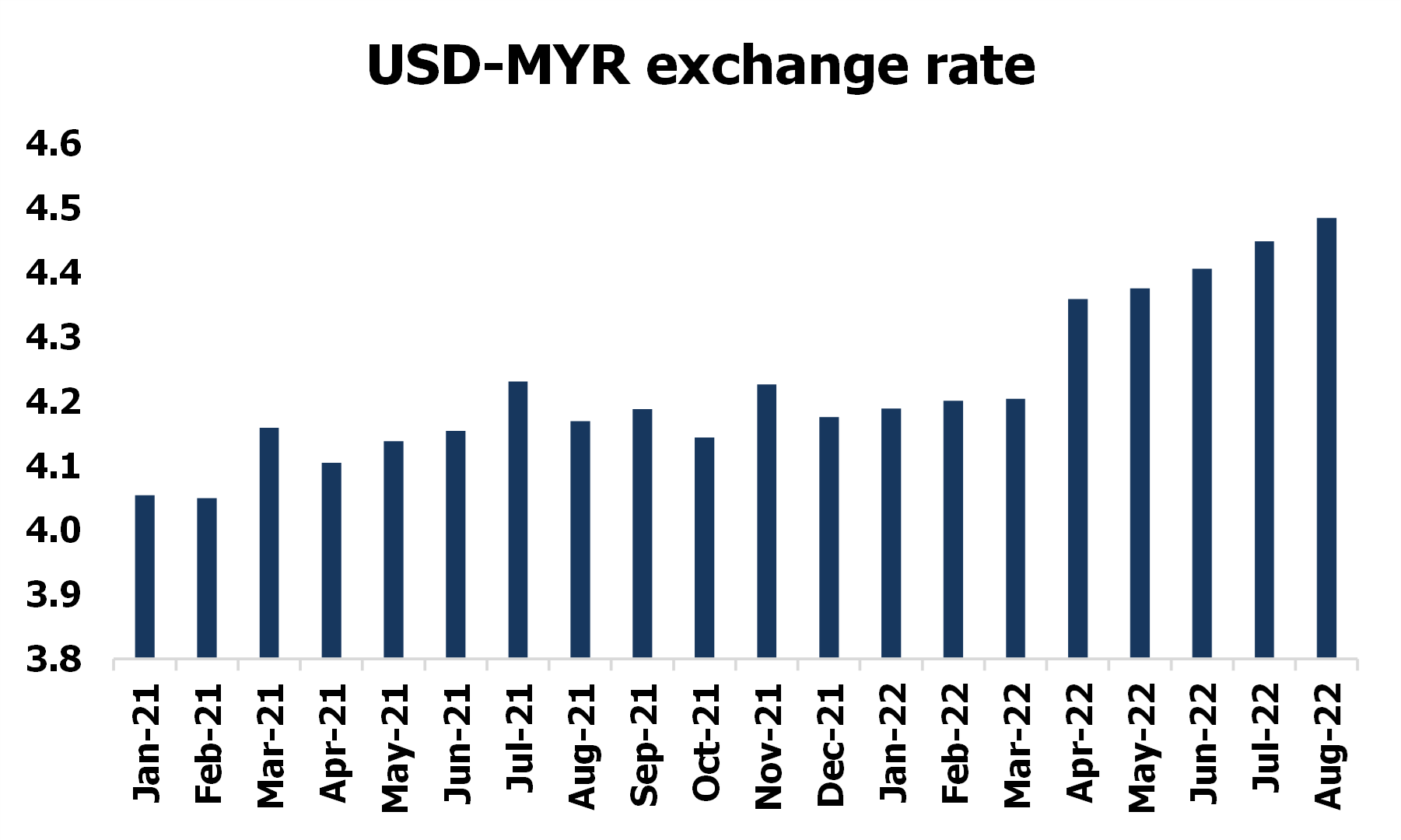

Meanwhile, we see the ringgit remaining under pressure in the coming months for reasons that are expected to include: a) aggressive interest rate hikes by a hawkish US Federal Reserve; b) disappointing economic data from a zero COVID–obsessed China that has dampened oil prices; and c) political rhetoric in Malaysia.

Against these evolving backdrops, we expect BNM to remain on a rate tightening path. We foresee the MPC, given its stated preference for measured and gradual monetary policy adjustments to support sustainable economic growth amid price stability, hiking the OPR by another 25 basis points to 2.75% in its November 2022 meeting.

| Chart 1: Third OPR hike in a row | Chart 2: Growth outlook continues to improve | |

|

|

|

| Sources: CEIC, MARC Ratings | Sources: CEIC, MARC Ratings | |

| Chart 3: Inflationary pressure rising | Chart 4: Ringgit in a weak mode | |

|

|

|

| Sources: CEIC, MARC Ratings | Sources: CEIC, MARC Ratings | |

Contacts:

Lyana Zainal Abidin, +603-2717 2912/ norlyana@marc.com.my

Lee Si Xin, +603-2717 2942/ sixin@marc.com.my

Quah Boon Huat, +603-2717 2931/ boonhuat@marc.com.my