Growth headwinds abound in 2H2022. The US Federal Reserve's aggressive rate hikes, the Russia-Ukraine military conflict in Europe, and China's zero-Covid strategy have sent shockwaves globally. Southeast Asian economies appear to rebound strongly in 2022, but the rising food and energy prices may not sit well from the socio-economic perspective.

The latest projections by major multilateral banks (MDBs) are in concert that growth in 2022 will come in lower than their earlier estimates. By extension of the downward revision of global growth, major economies – the US, Euro area and China – are expected to grow slower than in 2021. The good news, however, is that Southeast Asian countries are likely to perform better in 2022.

Malaysia's growth recovery momentum should continue as the economy reopens. As a small and open economy, Malaysia is not spared from external pressures. It is worth pointing out that the Russia-Ukraine military conflict's direct economic impact on Malaysia is small as trade and investments with these two countries are hardly significant. However, we think that the conflict's indirect impact, coupled with pressures from other major economies, is straining Malaysia's fiscal position and policymaking.

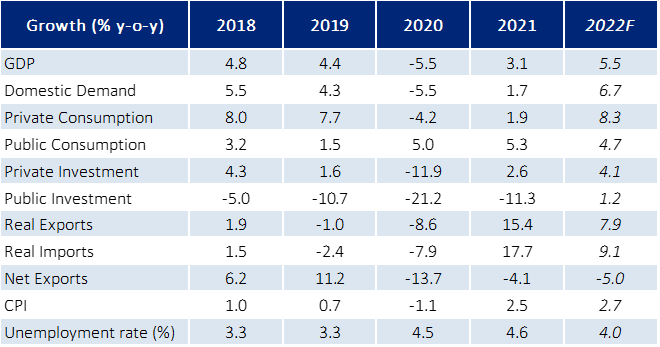

For full-year 2022, we expect GDP growth — mainly driven by private consumption growth (2022F: 8.3%; 2021: 1.9%) — to come in at 5.5% (2021: 3.1%), which is at the lower bound of the government's 5.3%-6.3% revised forecast range. The unemployment rate for 2022 will likely average around 4.0%, down from 2021's 4.6%. Given supply chain bottlenecks and supply shocks triggered by the military conflict, we project this year's average pace of inflation will likely rise to 2.7%.

BNM's two consecutive 25-basis point (bp) hike to 2.25% did not only signal the improving economic conditions, but it was also a pre-emptive measure to brace Malaysia for external headwinds driven by unprecedented global monetary tightening. Amid this backdrop, we expect the ongoing rate hikes to continue to 2.75% by year end.

In 2021, Malaysia's fiscal deficit had risen further to 6.4% of GDP from the previous year's 6.2%. Our forecast for this year stands at 6.0%, which aligns with the government's projection.

In tandem with the rising fiscal deficit, total direct federal government debt rose to 63.4% of GDP in 2021 from 62.1% previously. Debt service charges have also surged past the administrative ceiling of 15% of revenue, which stood at 17.8% at end-2021. As such, we do not foresee the government introducing more stimulus packages to support the economy in 2022.

It is worth pointing out that the federal government's operating expenditure/revenue ratio has been hovering near 99% since 2011. Thus, we think it is possible that the current federal government statutory debt ceiling — which has been lifted twice already, supposedly temporarily, first to 60% of GDP and then to 65% — could be lifted again soon to, say 70%. After all, the government expects statutory debt in 2022 – comprising Malaysian Government Securities, Malaysian Government Investment Issues and Malaysian Islamic Treasury Bills – to rise to 63.0% of GDP (2021: 59.7%).

The pace of recovery of Malaysia's labour market has been sluggish. This is concerning because weak labour market recoveries are among the key causes of economic scarring, thus increasing the need for higher subsidies in 2022 to maintain social harmony.

Despite a narrowing policy space, the Malaysian government has been successful in lessening the possibility of a sovereign rating downgrade thus far. Moving forward, we believe that international credit rating agencies will monitor closely the deleterious economic impact can have on attitudes towards reforms, and consequently, the credibility and effectiveness of institutions and governance processes.

Source: MARC Ratings

Source: MARC Ratings

The full report can be accessed here.

Contacts:

Firdaos Rosli, +603-2717 2936/ firdaos@marc.com.my

Quah Boon Huat, +603-2717 2931/ boonhuat@marc.com.my