In this multi-part series, we dissect drivers of currency phenomena, including: i) interest rate perceptions, ii) current account (CA) intricacies and the real economy, iii) capital flow dynamics in the financial account, and iv) money supply theories in relation to debt levels and the fiscal position. In this third part, we discuss the impact of global portfolio flows and net investment position on currency sentiment.

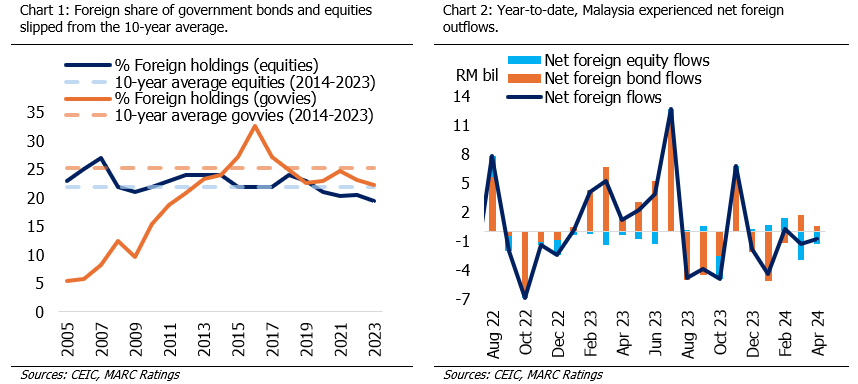

Fluctuations in the Malaysian ringgit can arise from changes in the demand and supply of financial assets denominated in different currencies. Portfolio flows are often judged by their short-term nature, although their longer-term trends provide constructive structural implications. Since 2005, the foreign share of government bonds ranged from 4% to 36%, with the latest being 21% as at April 2024. At 21%, foreign holdings are near the long-term average, suggesting that foreign investors have retained their interest in Malaysian government bonds despite currency volatilities caused by pivotal shifts in global interest rates. While foreign holdings are below the 10-year average, there is no evidence of capital flight from Malaysia surpassing historical norms.

Nonetheless, further foreign capital inflows would be beneficial to Malaysia. Should the share of foreign holdings of Malaysian bonds increase from the present 21% to the historical high of 36%, Malaysia could realise more than RM170 billion worth of inflows or a 71% increase in foreign holdings of its government bonds.

Raising the level of interest in the Malaysian capital markets requires a multi-year strategy of aligning with international investment frameworks. For example, although Malaysia was initially admitted to the FTSE World Government Bond Index in April 2004, it required several years and the subsequent admission to other bond indices before foreign holdings of government securities approached the 20% level in 2010. Furthermore, when foreign holdings exceeded 30% of the outstanding bond market in 2015, this was accompanied by favourable external conditions, whereby Malaysia had a substantial interest rate spread of 300 basis points above the US, while Malaysia’s key commodity exports’ prices were rising.

Several steps could be taken to continuously enhance Malaysia’s structural attractiveness as an investment destination: i) improve Malaysia’s country risk and sovereign credit rating; ii) raise the openness of market access; and iii) increase market size and liquidity. Market access includes wide-ranging criteria such as a simple and consistent foreign exchange policy, an easy registration process for international investors, ready access to a liquid derivatives market with multiple product types, lowered tax and transaction costs, and efficient settlement and custodial systems.

Year-to-date, Malaysia’s capital markets have witnessed net foreign outflows, recording RM4.0 billion outflows in the local bond market and RM2.1 billion outflows in the domestic equity market as of April. This further highlights the importance of market microstructure factors to bolster the persistence and increase of portfolio investments.

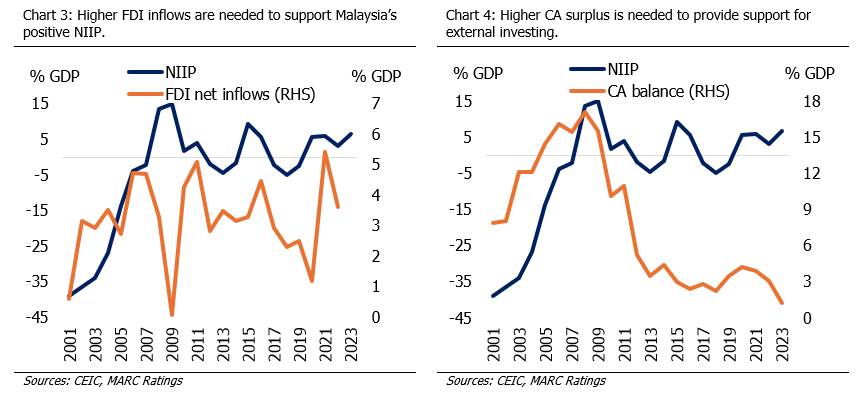

An ongoing debate concerns whether Malaysia’s overseas investments have contributed to the depreciation of the ringgit. Malaysia’s net international investment position (NIIP) has consistently remained positive since 2008, reaching 6.6% of gross domestic product (GDP) in 2023, indicating that Malaysia possesses more foreign assets than liabilities. While the immediate effect of overseas investments causes outflows, a stable and structurally positive NIIP bolsters Malaysia’s ability to withstand external shocks, demonstrating creditworthiness, access to global capital markets, and the potential for future returns on investments. However, sustaining a positive NIIP requires continued accumulation of foreign reserves and CA surplus.

Thus, in addition to portfolio flows, it is key to boost foreign direct investment (FDI) flows into Malaysia to further support NIIP over time, in line with the government’s strategic plans (see the second part of this series), and it is encouraging that Malaysia’s FDI has rebounded to 3.6% of GDP in 2023 from a low of 1.2% during the pandemic in 2020. Apart from a positive NIIP position, continued inward FDI would result in a trend of rising NIIP, supported by the characteristic persistence of FDI. The focus on structural reforms by Malaysia’s government is necessary to enhance Malaysia’s relative attractiveness as a destination for both persistent portfolio and direct investments.

This press announcement is the third in a multi-part series discussing our opinions over the ringgit’s pathway and accompanying adjustments that can potentially be made to better align the value of the ringgit, such that it reflects Malaysia’s solid fundamentals.