The worldwide energy landscape is currently experiencing a complex interplay of factors that are shaping the oil market’s near-term price outlook. Amid ongoing geopolitical conflicts in Eastern Europe and the Middle East, supply disruptions, expectations of steady global gross domestic product (GDP) growth in 2024, and the persistence of medium-term oil dependency despite evolving environmental policies, MARC Ratings expects oil prices to remain elevated for the remainder of 2023 and into 2024.

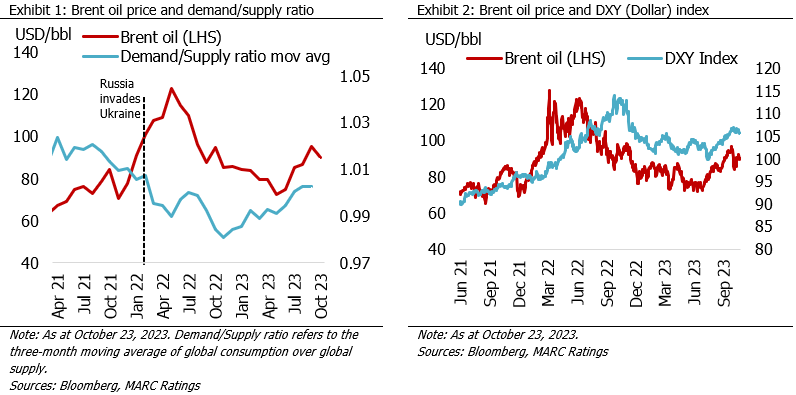

Presently, global geopolitical tensions are the predominant catalyst for short-term fluctuations in oil prices. To illustrate, the Russia-Ukraine conflict that commenced in February 2022 led to a subsequent 25% surge in Brent oil prices, resulting in a sustained period of elevated prices above US$100 per barrel for four months. Even prior to the conflict, higher oil prices had been attributed to escalating tensions in the region dating back to the troop build-up near the Russia-Ukraine border since the spring of 2021. The current Israel-Hamas conflict has introduced multiple geopolitical risks that could potentially have a more substantial impact on oil prices compared to the Russia-Ukraine War. This is due to the involvement of various geopolitical factions, potentially expanding the conflict zone significantly. Additionally, ongoing US-Iran tensions and the possibility of sanctions may lead oil price futures to factor in the risks associated with the closure of the Strait of Hormuz, a critical oil-shipping channel for approximately a fifth of the world’s oil. Regardless of whether these event risks materialise into physical supply disruptions, the persistent geopolitical tensions are likely to exert upward pressure on oil prices.

In the absence of geopolitical events, supply-demand dynamics in the oil market may continue to bolster oil prices. As the world’s largest oil importer, China has shown signs of economic recovery, with better-than-expected growth in 3Q2023. This has prompted forecasters to revise their estimates for China’s 2023 GDP growth to 5% and above, countering concerns about China’s ongoing property market malaise. China’s oil imports rose by 12% to an average of 11.4 million barrels per day (mbpd) in 1H2023, compared to 10.2 mbpd in the same period in 2022. Additionally, a global inventory drawdown occurred in 3Q2023, and demand is expected to remain robust as markets head into the Northern Hemisphere winter.

On the supply side, production cuts are likely to keep total OPEC production below the pre-pandemic 2015-2019 five-year average of 36.2 mbpd, primarily due to Saudi Arabia’s and Russia’s commitment to extending production quota cuts in favour of higher oil revenue over market share. Furthermore, US trade sanctions against Russia and the possibility of further sanctions against Iran could further constrict both actual and expected supply, intensifying the upward pressure on oil prices.

In view of ongoing geopolitical developments, supply dynamics, financial markets, and seasonal effects, MARC Ratings anticipates Brent oil prices to hover around US$85-US$95 in 4Q2023 and within the range of US$80-US$100 in 2024. However, should there be more severe and widespread geopolitical conflicts affecting the physical supply and transportation of oil, Brent oil prices may surpass US$100. Conversely, downside risks include the de-escalation of geopolitical risks, weaker-than-expected growth in China and the eurozone, alongside rising production by non-OPEC members and a temporary waiver of US sanctions on Venezuelan oil. Additionally, an unexpected ending of voluntary production cuts by Saudi Arabia, Russia, and other OPEC+ members may also place downward pressure on oil prices.