The global interest rates outlook is at a crossroads following aggressive monetary policy tightening in advanced economies. The nascent global economic recovery has been uneven thus far, with a confluence of factors shaping the economic landscape and adding uncertainties to the global and domestic interest rate outlook. This includes persistently elevated inflation in the advanced economies, upside pressure on oil prices due to global geopolitical tensions, and weakening growth momentum in Europe.

At present, we observe signs of divergence in economic momentum among major economies. US growth remains healthy, China’s economy is recovering despite property sector distress, while the eurozone’s growth remains tepid, complicating the return to pre-pandemic output trends. Another central bank dilemma globally is the inflation outlook, as low unemployment and a slower pace of rising inflation offer market relief, although meeting major central banks’ inflation targets remains challenging.

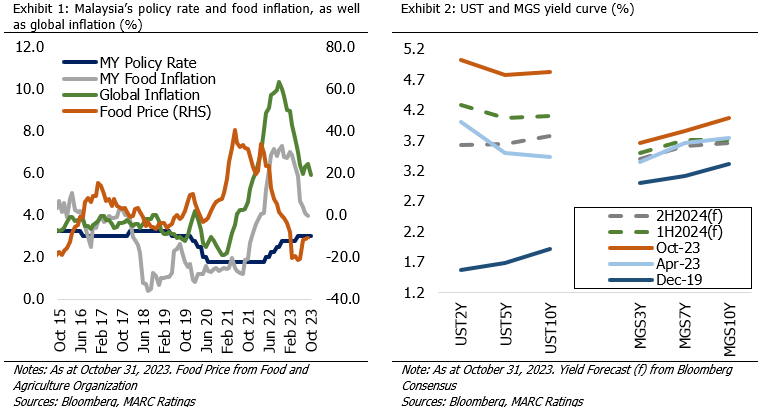

Central banks in advanced economies are likely to exercise caution in concluding the current tightening cycle, followed by the possibility of fewer policy rate cuts in 2024. With regard to the global bond market, while there was a rise in interest rates around the world over the last two years, the increase in: i) commodity prices and inflation expectations driven by geopolitical risks, and ii) public debt deficits and supply of bonds, may lead to an extended period of already high bond yields, regardless of anticipated interest rate cuts. In 2024, we expect 10-year yields of US Treasuries (UST10Y) and Malaysian Government Securities (MGS10Y) to remain elevated at 4.10%-4.30% and 3.80%-3.90% (end-Oct: 4.93%; 4.10%).

Amid ongoing negative interest rate differentials and risk of capital outflows, the weak ringgit alongside emerging market currencies could possibly persist. For emerging markets’ currencies to improve, greater clarity on the possibility of a further extended period of US interest rate cuts is required. Concurrently, the stability of emerging markets will be influenced by the extent to which interest rate cuts are eventually delayed, which may consequently have an adverse effect on economic growth rates. We expect the ringgit to trade within the 4.40-4.70 range in 2024, contingent on domestic catalysts and progress of ongoing structural reforms, particularly reforms associated with fiscal consolidation.

Malaysia’s resilient private consumption, a firmer labour market and global trade diversion are expected to be supportive of a slightly stronger economic growth momentum of 4.0%-4.5% in 2024. However, a steeper-than-expected slowdown in trade would be the primary growth risk next year. On inflation, our base case headline inflation forecast is anticipated to be around 2.4%-2.8% in 2024 (2023F: 2.8%) as inflation pressures continue to ease from a high base. Nonetheless, we foresee upside risks to our 2024 inflation forecasts, given the ripple effects of the anticipated rollout of the targeted subsidies mechanism and elevated commodity prices amid geopolitical tensions, as reflected in the Ministry of Finance’s broad inflation forecast range of 2.1%-3.6%. The timing and extent of shifts from broad-based to targeted subsidies remain unknown at this stage.

Given the spillover from tight global monetary conditions and domestic inflation upside risks, MARC Ratings foresees the Overnight Policy Rate (OPR) in 2024 at 3.00%, with the potential for a hike to 3.25%. In its statement on November 2, 2023, BNM views the current OPR level to be supportive of the economy. Should the interest rate rise, Malaysia’s strong banking system has the capacity to absorb potential credit risks and costs associated with higher interest rates, affording the central bank significant policy flexibility.