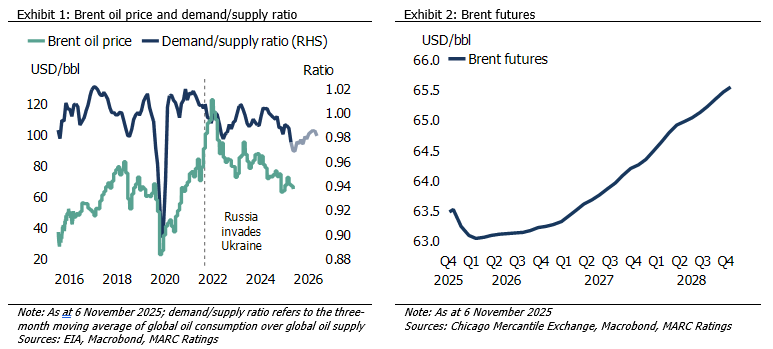

The global crude oil market will enter 2026 on a weaker footing, as the combined effects of sustained high supply, subdued demand growth, and ongoing global energy transition continue to exert downward pressure on prices. Despite intermittent geopolitical issues, the fundamental imbalance between supply and demand is expected to remain a dominating factor in price movements next year. MARC Ratings forecasts Brent crude prices to average between USD60 per barrel (bbl) and USD70/bbl in 2026, marking a further moderation from 2025 forecast levels of around USD68/bbl–USD69/bbl (year-to-date October 2025: USD69.30/bbl), but within MARC Ratings’ initial forecast range of USD65/bbl–USD75/bbl.

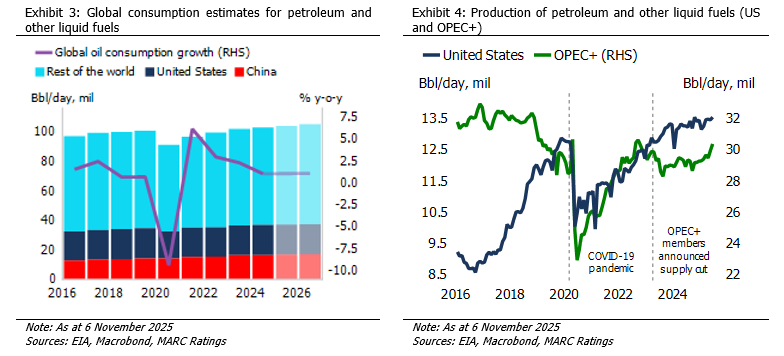

Supply dynamics will remain a key determinant of oil price direction. OPEC+ is expected to gradually ease its voluntary production cuts, which began in May 2025 and further relaxed in September 2025; supply cuts have been challenging to execute as member countries face increasing fiscal pressures and seek to increase export volumes. Nonetheless, the region’s top three largest producers, namely the gulf states of Saudi Arabia, Iraq and the United Arab Emirates, are expected to lead supply normalisation, with a collective output of around 17.7 million barrels per day (mbpd) to the global supply in November 2025 (2024 average: 15.7 mbpd). At the same time, non-OPEC producers, particularly the United States (US), are projected to sustain their output. According to the US Energy Information Administration (EIA), US crude oil production could remain unchanged at 13.5 mbpd in 2026, supported by government policies to enhance energy security as well as continued efficiency gains and cost optimisation. Combined, these developments are expected to support the total global oil supply, with production forecast to be at 107.2 mbpd in 2026 (2025: 105.9 mbpd), representing an annual growth rate of 1.2% (2025: 2.6%).

On the demand side, global consumption of oil is anticipated to remain sluggish, constrained by the structural shift towards renewable energy and improvements in energy efficiency. Although the ongoing global monetary easing cycle, led by the US Federal Reserve and the European Central Bank, could stimulate industrial activity, its impact on oil demand is expected to be limited. Much of the stimulus will reinforce financial asset valuations rather than real sector expansion, while the transmission to energy-intensive industries will be muted by weak global manufacturing momentum. China, which accounts for around 16% of global consumption, continues to face headwinds from the weak property and manufacturing sectors, while accelerating its efforts to decarbonise. The EIA projects Chinese oil demand growth to be a mere 1.4% in 2026 (2025: -1.5%) compared to an average of around 3.5% during the post-pandemic rebound years. Elsewhere, demand in Organisation for Economic Co-operation and Development (OECD) economies will likely remain subdued due to ongoing electrification of transport and energy efficiency measures, while India may continue to provide a modest offset through steady consumption growth. India is expected to increase its demand by 1 mbpd, the largest increment globally. Overall, global oil demand growth is projected to reach 105.1 mbpd in 2026, expanding from the 104.0 mbpd in 2025, relatively sustaining the growth pace at 1.1% (2025: 1.0%).

The demand/supply ratio is projected to remain below parity in 2026, as production is expected to exceed consumption, consistent with the persistent oversupply trend. This marks a clear shift from the tight market conditions of 2022, when the ratio briefly surpassed 1.0 following the Russia–Ukraine conflict, triggering sharp price gains. The expected moderation in the ratio to around 0.96–0.97 reflects the combined effects of steady non-OPEC output, easing OPEC+ cuts, and soft demand growth, factors that are collectively keeping the market comfortably supplied. This is consistent with Brent oil prices stabilising in MARC Ratings’ forecast range of USD60/bbl–USD70/bbl.

While geopolitical risks, particularly in the Middle East, will continue to drive short-term price volatility, recent developments point to a potential ceasefire in the region, which could help stabilise sentiment and reduce risk premiums. Nonetheless, Western sanctions on Russian oil will likely provide some support to prices, as restrictions on Russian crude and refined products escalate. Some Chinese petroleum companies, including Sinopec and PetroChina, have reportedly cancelled or scaled back contracts due to blacklisting pressures, potentially constraining supply availability in parts of the Asian market.

Following the latest US sanctions on Russia’s oil majors, crude held aboard tankers has risen to multi-year highs, as cargoes face longer idle periods and rerouting; media reports suggest that several million barrels remain in floating storage, a scale comparable to levels observed during earlier episodes of trade dislocation. Market indicators also suggest a well-supplied environment in the near term, as the Brent futures curve is in backwardation between 4Q2025 and 1Q2026, before transitioning into a gradual contango from mid-2026 as demand recovers and prices mean-revert.

Taking into account the interplay of loosening OPEC+ production management, robust non-OPEC output, and muted demand recovery, MARC Ratings expects Brent oil prices to remain within the USD60/bbl–USD70/bbl range in 2026. Upside risks include the escalation of geopolitical conflicts involving major producers, a slower-than-anticipated return of OPEC+ supply, or stronger-than-expected global economic growth. Conversely, downside risks stem from a faster recovery of OPEC+ output, persistent oversupply, or accelerated clean energy adoption that further weakens demand. Overall, the crude oil market in 2026 is likely to remain characterised by ample supply, cautious demand, and constrained price upside, a reflection of a global energy system in gradual transition.