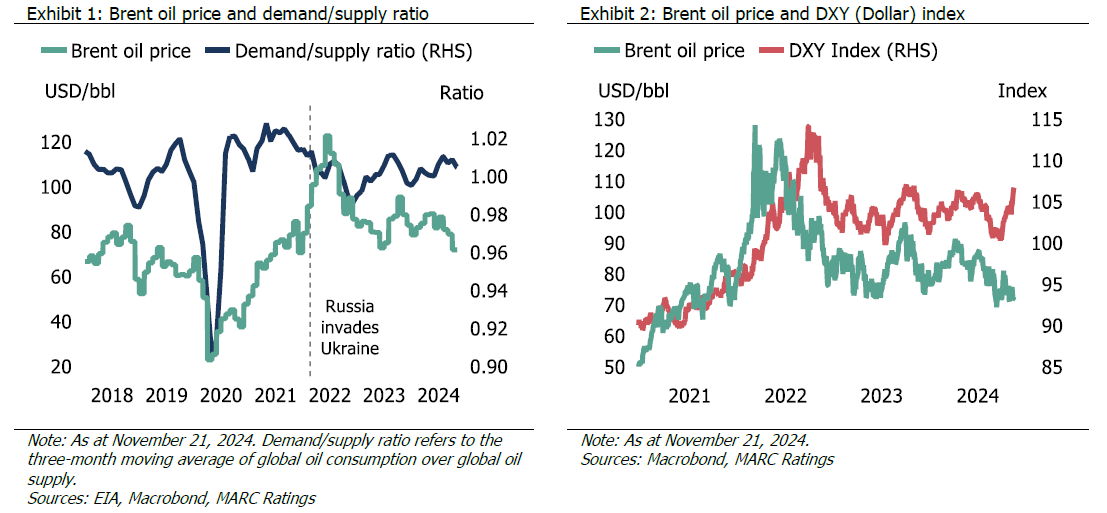

The global crude oil market is grappling with multiple challenges, each exerting pressure on the near-term price trajectory. Despite OPEC+ production cuts, slow demand growth and diminishing geopolitical risk premiums have kept Brent oil prices below USD80 per barrel (bbl) since 3Q2024. Heading into 2025, oil prices are expected to be weaker compared to those in 2024. MARC Ratings forecasts that oil prices in 2025 will likely range between USD65/bbl and USD75/bbl, while the oil price in 2024 is expected to average around USD80/bbl, in line with the low end of our forecast range.

Despite diminishing effects, geopolitical tensions continue to drive short-term oil price volatility, with recent spikes reflecting heightened instability in the Middle East. However, Iran’s energy infrastructure remains intact, and there has yet to be any impact on the Strait of Hormuz, a crucial transit route for roughly one-fifth of global oil demand. A disruption in production or along the transit routes could trigger a sharp surge in crude oil prices; based on our estimates, a 10% reduction in oil supply could potentially drive prices up by 12%.

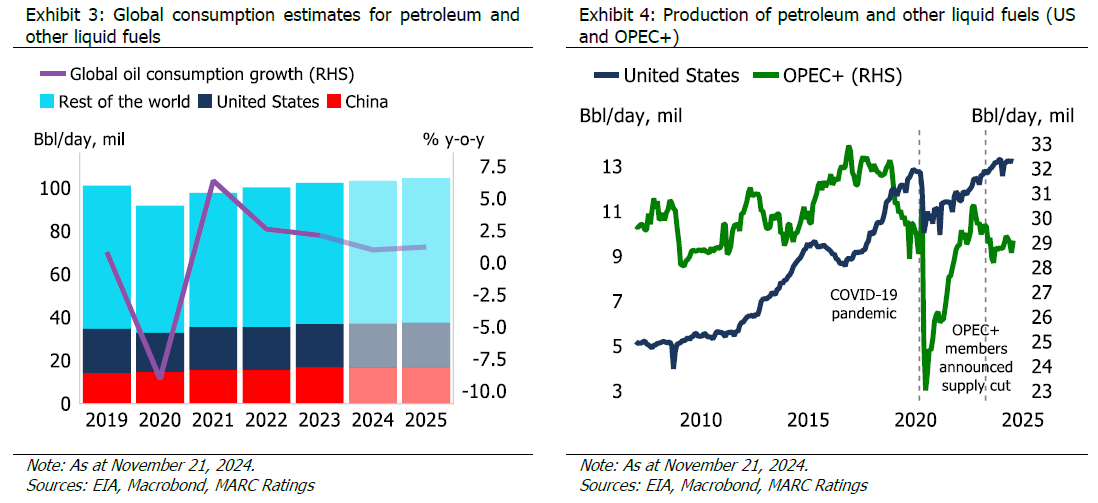

In terms of demand, the ongoing loosening of global interest rates, particularly in the US, could revitalise manufacturing activity and weaken the dollar in 2025. However, dollar weakness will depend on bond yield movements, which are influenced by shifts in US policy on public spending. Global demand for crude oil may follow suit, though the pace and scale of this recovery would remain uncertain. In 2024, weaker-than-expected macroeconomic performance and high interest rates have constrained demand, with global consumption growth decelerating to 1.0% (2023: 2.1%; 2022: 2.6%). China, the world’s largest oil importer, saw its imports drop by 3.5% through the first 10 months of 2024 (10M2023: 14.5%). Global consumption of oil could improve to 1.2% in 2025 as global easing of interest rates takes effect, alongside a recovery in demand from China. However, China’s growth faces increased downside risks due to the potential rise in US protectionism following Donald Trump’s victory in the recent presidential election.

Production of global crude oil and other liquid fuels is projected to grow by 2.0% in 2025 (2024: 0.6%; 2023: 1.8%), largely driven by increased output from the US, where production is expected to expand by 2.3%, according to data from the Energy Information Administration (EIA). This growth aligns with Republican policies prioritising energy security, where potential deregulation of traditional energy policies could further boost output. Additionally, OPEC+ plans to begin easing its production cuts at the end of December 2024, increasing supply to the market. Therefore, persistently high output, coupled with oversupply concerns, is expected to place downward pressure on prices, barring any significant geopolitical disruptions.

Considering the interplay of geopolitical tensions, demand constraints, and robust supply, MARC Ratings projects Brent oil prices to range between USD65/bbl and USD75/bbl in 2025. However, this projection is subject to upside risks, including a potential escalation of geopolitical conflicts involving key oil suppliers, stronger-than-expected economic performance in the US and China, and the extension of production cuts by OPEC+ members. Conversely, downside risks include a faster-than-anticipated recovery of OPEC+ production, a significant increase in non-OPEC output, or the resolution of geopolitical conflicts.