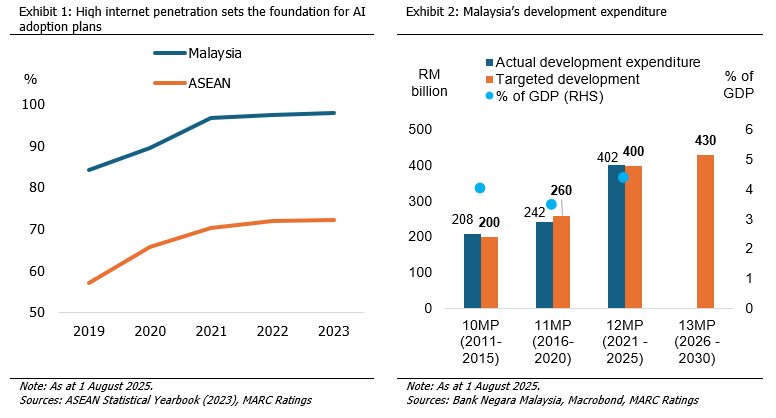

On 31 July 2025, the Malaysian government unveiled the 13th Malaysia Plan (13MP), outlining the country’s development framework for the next five years (2026–2030). Key highlights include total investments amounting to RM611 billion, of which RM430 billion is earmarked for development expenditure. This translates into RM86 billion annually, on par with the development allocations in the government’s previous two budgets (2024 and 2025). The 13MP also explicitly allocates RM181 billion in contributions from government-linked companies (GLCs), government-linked investment companies (GLICs), and public-private partnerships (PPPs), underscoring the pivotal role of the private sector in driving national development.

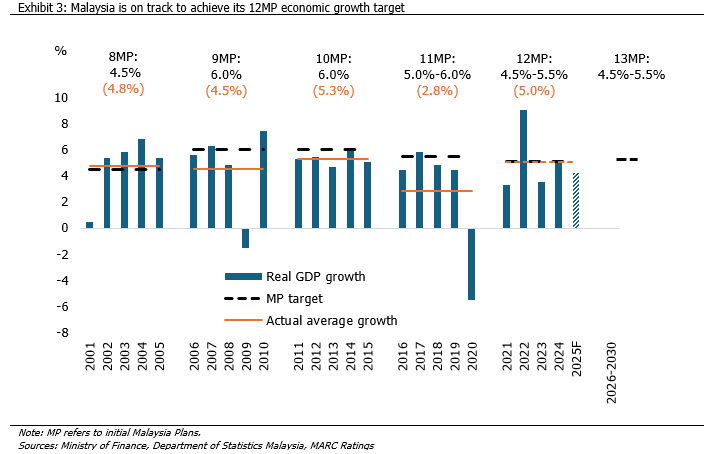

In the 13MP, the government is targeting an annual gross domestic product (GDP) growth rate of 4.5% to 5.5%, moderating from the 12MP mid-term review target of 5.0% to 5.5%. At present, Malaysia is on track to achieve its 12MP growth target. The moderation in the 13MP’s GDP growth target appears reasonable, considering the decade-average GDP growth rate of 4.2% (2014-2024). Historically, some 12MP targets appeared ambitious, which, for example, can be evaluated via achievement levels in 2024, including gross national income (GNI) per capita (2024: RM56,718; target: RM61,000), labour productivity growth (2024: 2.4%; target: 3.6%), and fiscal deficit (2024: 4.1% of GDP; target: 3.0%-3.5% of GDP). Under the 13MP, several headline targets remain unchanged from the initial 12MP, including labour productivity growth (3.6% p.a.), and headline inflation (2% to 3%).

The overarching theme of the 13MP is “Melakar Semula Pembangunan”, meaning “Redesigning Development”, and it continues to build on the MADANI framework. National strategic master plans such as the National Semiconductor Strategy (NSS), New Industrial Master Plan (NIMP), and National Energy Transition Roadmap (NETR) remain central to Malaysia’s long-term development. A key focus of the 13MP is to position Malaysia as a regional hub for digital and artificial intelligence (AI). Malaysia is well-positioned to realise this ambition, with internet penetration reaching 98.0% in 2023 — well above the ASEAN average. Efforts to expand 5G coverage to 98% nationwide by 2030 are also underway, further strengthening digital infrastructure. Additionally, the National AI Plan 2030 provides a comprehensive framework to guide Malaysia’s advancement in this field.

The 13MP also targets an expansion of the manufacturing workforce by 700,000, particularly in high-growth, high-value (HGHV) and advanced technology sectors. Existing master plans, such as the NSS, support Malaysia’s shift up the semiconductor value chain. To facilitate this transition, Technical and Vocational Education and Training (TVET) programmes will be strengthened to match industry needs. In addition, the digital economy will be further prioritised under the 13MP, with continued implementation of the Malaysia Digital Economy Blueprint. A target has been set to create an additional 500,000 jobs in the digital economy space. If successfully achieved, these initiatives could contribute an additional RM21,000 to Malaysia’s GNI per capita, helping to meet one of the key goals of the 13MP.

Structural reform is another cornerstone of the 13MP. The plan outlines clear targets aligned with the Public Finance and Fiscal Responsibility Act 2023, including reducing the fiscal deficit-to-GDP ratio below 3% and keeping the debt-to-GDP ratio under 60% by 2030. To support these fiscal objectives, the government is pursuing consolidation through targeted subsidy rationalisation, greater use of PPPs, improved cost controls on development projects, and tax system enhancements. In parallel, institutional reforms are being rolled out to strengthen public sector efficiency and accelerate digital transformation through initiatives such as GovTech and MyDigital ID. Together, these efforts aim to improve fiscal discipline, enhance service delivery, and restore public trust in government institutions.

Overall, the 13MP marks a positive development for the country. Its emphasis on fiscal discipline, structural reforms, and high-value investment — particularly in digital and advanced manufacturing — reinforces Malaysia’s long-term growth prospects and macroeconomic stability. If effectively implemented, the plan could improve the country’s credit fundamentals and support its aspiration to transition into a high-income economy.