The palm oil market continues to face significant uncertainties heading into 2025, with supply-side challenges exacerbated by adverse weather conditions and a slower pace of replanting. Palm oil prices in 2024 have remained elevated due to global supply constraints, driven by reduced exports from the largest palm oil producer, Indonesia, as well as recent adverse weather conditions in Malaysia. Looking ahead, palm oil prices are expected to remain high, averaging RM4,600/metric tonne (MT) in 2025 (2024F: RM4,200/MT; 2023: RM3,812/MT).

Demand for palm oil in biodiesel production remains robust, supported by policy mandates in Indonesia. The biodiesel blend rate is set to increase to 40% (B40) in 2025 from the current 35% (B35), with further plans to raise it to 50% (B50). The Indonesian Palm Oil Association (GAPKI) estimates that achieving B40 will require an additional 1.7 million MT of palm oil, while reaching B50 could drive demand higher by an additional 5 million MT. This increase underscores the growing role of biodiesel as a driver of palm oil consumption.

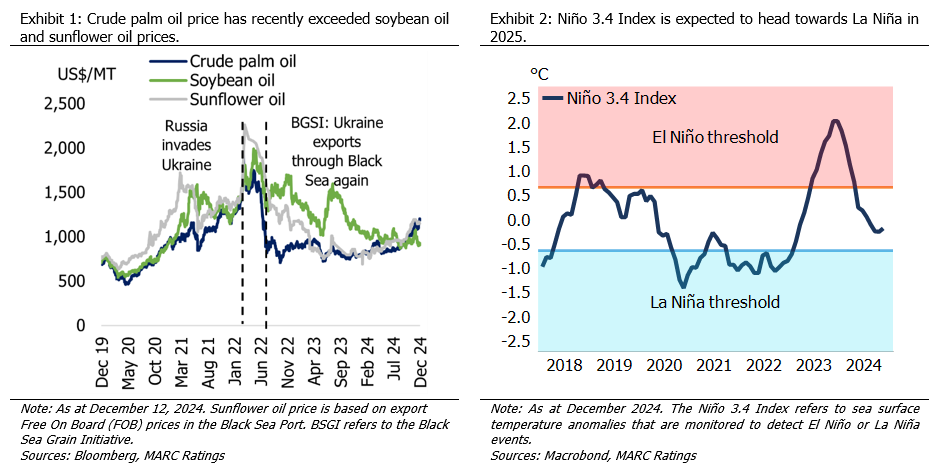

Global edible oil demand remains an important factor, as palm oil is usually a cost-effective alternative to other vegetable oils. Palm oil is also a key feedstock for processed foods. The global import volume of palm oil is forecast to rise to around 44.6 million MT in 2025 (2024: 42.9 million MT), while domestic consumption is projected to reach 78.3 million MT (2024: 75.1 million MT), according to the United States Department of Agriculture’s (USDA) latest estimates. Based on current prices, palm oil is positioned higher than substitutes such as soybean oil and sunflower oil, which may constrain demand growth. Meanwhile, price effects caused by regulatory changes, such as India’s hike in edible oil customs duties and the delayed implementation of the European Union Deforestation Regulation (EUDR) to 2026, are expected to balance out.

Key substitutes for palm oil, such as sunflower oil and rapeseed oil, may face supply constraints, supporting higher prices. Drier-than-average weather conditions in major producing regions, including Canada, Ukraine, and Russia, are likely to impact production. Additionally, the ongoing Russia-Ukraine conflict continues to disrupt the global sunflower oil supply, keeping inventories tight. Sunflower oil production is projected to decrease to approximately 20.0 million MT in 2025 from 2024’s 22.1 million MT.

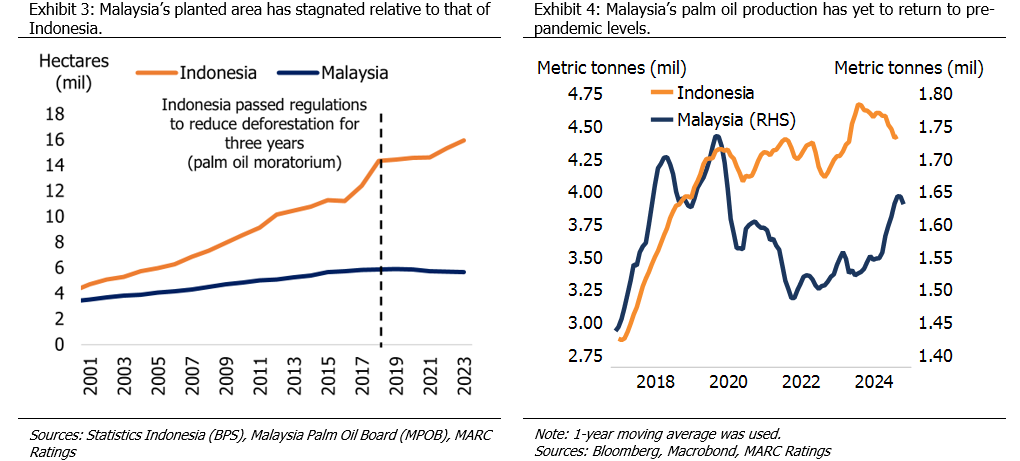

As oil palm is a weather-sensitive crop, palm oil production will face constraints due to persistent wet weather conditions, which have led to flooding in key production states. The Malaysian Meteorological Department forecasts that this high rainfall trend will continue at least through 1Q2025, with a potential for La Niña weather conditions. However, as weather conditions normalise in the latter half of the year, drier weather could improve growth and harvesting conditions, though its full impact on production may only be realised in 2026.

Replanting progress for oil palm trees remains below target. Malaysia replanted 132,000 hectares (ha), or 2.3% of its total planted area, in 2023 (2022: 97,130 ha, 1.7%), falling short of the government’s annual target of 4%. This target represents 228,000 ha but is still well below the 450,000 ha of trees aged 25 years or older that need replacement, due to yields declining significantly after 20 years. Similarly, Indonesia has made limited progress on its ambitious goal of replanting 2.5 million ha by 2025, achieving only 206,000 ha in 2023. The slower replanting pace adds to supply constraints.

Palm oil prices are expected to face upward pressure in the near term due to supply constraints, seasonal production declines, and reduced inventories. Production typically peaks in September or October before tapering off in the first quarter of the following year. On the demand side, biodiesel mandates, rising edible oil consumption, and geopolitical factors impacting substitute oils are likely to support prices.

Heading into 2025, palm oil prices are projected to average RM4,600/MT (2024F: RM4,200/MT). Upside risks include lower-than-expected soybean production and increasingly restrictive palm oil export policies by Indonesia. Conversely, downside risks include weaker-than-expected demand from key markets such as China and India, weather conditions, and increased production of other substitute edible oils.