This is a multi-part series of articles where we analyse the elements of fiscal sustainability through: i) government revenue and expenditures, ii) on– and off–government balance sheet items, and iii) innovative sustainability ratios. In this first part, we discuss Malaysia’s fiscal health through taxes and expenditures.

Fiscal sustainability enables governments to meet future public expenditure and financial obligations without resorting to excessive borrowing. Raising sufficient revenue while balancing current spending requirements builds buffers for future economic shocks.

Higher government debt levels over the long term necessitate a faster pace of current revenue generation and expense reduction, essential for a sustainable fiscal balance. Against the backdrop of the global trend towards fiscal consolidation amid elevated debt levels, moderate global growth prospects and higher borrowing costs, Malaysia’s Public Finance and Fiscal Responsibility Act 2023 has capped the fiscal deficit at 3.0% of gross domestic product (GDP) while allowing for temporary deviations. The government aims to achieve this benchmark by 2026, which, if successful, would stabilise Malaysia’s elevated debt levels and align the deficit with the global median.

Self-sufficiency in revenue generation requires a wider tax revenue base. However, Malaysia’s tax revenue-to-GDP ratio has trended downwards over time from 15.5% in 2003 to 12.6% in 2023 and is projected to decline further to 12.3% in 2024. Moreover, this ratio has been lower than those of its ASEAN-6 peers since 2017 (2023 median of peers: 12.9%). Of note, while higher taxes are needed, welfare considerations for lower income groups are important to Malaysia’s government. As such, the medium-term revenue strategy is inclined towards higher tax rates with a more equitable tax structure such as windfall taxes and a progressive personal income tax rate.

Corporate income tax (CIT) collection, which constitutes nearly half of government revenue, remained level at 5.1% of GDP in 2023 (2003: 5.7%). Given that Malaysia’s CIT rate of 24% is already higher than the ASEAN-6’s median of 21%, other revenue-broadening measures could include phasing out income tax exemptions for industries that no longer require incentives. Certain sectors currently receive up to 100% income tax exemptions for up to 10 years to establish a presence in industrial economic corridors. However, as these corridors and sectors have matured, such lengthy and generous exemptions could be reduced. Going forward, corporate tax revenues may rise, as the anticipated Global Minimum Tax in 2025 will ensure multinational corporations contribute at least 15% in tax. This will address companies currently benefitting from lower rates due to policies such as tax incentives.

Given the decline in indirect taxes in Malaysia, which include taxes on goods and services, to 3.2% of GDP (2003: 5.2%), higher rates of the Sales and Services Tax (SST) and the recently implemented Low-Value Goods Tax should provide some improvement in tax collection. Nonetheless, indirect taxes were merely 26.5% of total tax revenue in 2022, much lower than the ASEAN-6 median of 43.0%. All else remaining the same, we estimate that a 10% increase in indirect tax collection could narrow the fiscal deficit by around 0.3% of GDP. While tax compliance remains a challenge, especially for direct taxes, Malaysia’s ongoing refinement of the e-invoicing system should enhance the efficiency of indirect taxes collection. Overall, widening the catchment of consumption tax is critical for fiscal sustainability, and this can be implemented through having a wider basket of goods for the existing SST or introducing a variant of the Goods and Services Tax or Value-Added Tax.

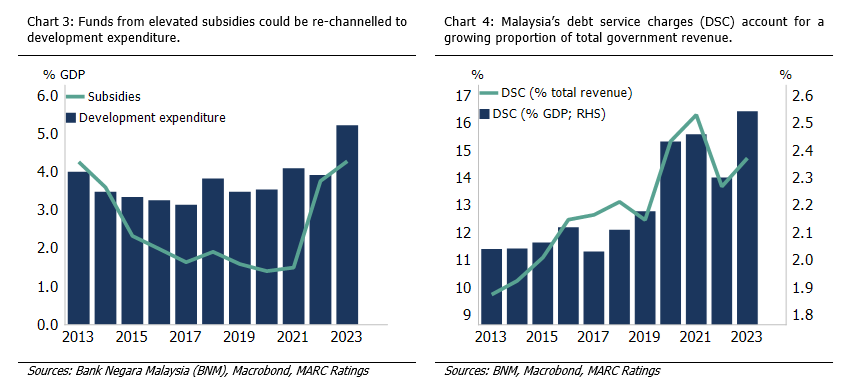

Optimising expenditure is key to balancing socioeconomic goals, as well as achieving higher economic growth and fiscal sustainability. This is particularly necessary in Malaysia due to the limited allocation for development spending which was only 23.4% of total expenditure in 2023. As over half of operating expenditure is committed towards public sector allocations and debt obligations, increasing debt service charges (DSC) may further constrain the fiscal space. In 2024, DSC as a share of revenue is expected to increase to 16.2% (2023: 14.7%), breaching the previously self-imposed threshold of 15.0%. Tightening public procurement regulations should help optimise economic returns from government spending while supporting fiscal consolidation.

Rationalising subsidies remains a key factor in capping government expenditure, as subsidies have increased as a share of Malaysia’s operating expenditure from 4% in 2003 to 25% in 2023. In 2022, Malaysia spent RM70.3 billion on subsidies, with fuel subsidies making up 74%. Consequently, ongoing fuel subsidy reform remains absolutely necessary, alongside the ongoing review of various subsidies such that the monies allocated are better targeted at disadvantaged groups in society. Ceteris paribus, we estimate that a 10% decrease in RON95 fuel subsidies could narrow the fiscal deficit by around 0.2% of GDP. At present, encouraging signs in the labour market, GDP growth and consumer spending should facilitate subsidy retargeting towards beneficial welfare outcomes.

This article is the first in a multi-part series sharing our opinions on Malaysia’s fiscal health and considerations in achieving fiscal sustainability.