Global investors closely monitor Malaysia’s national plans, which play a crucial role in attracting portfolio flows and influencing financial market outcomes, including the strength of the Malaysian ringgit. These plans provide essential information regarding Malaysia’s country risk and sovereign credit risk, shaping global investors’ perceptions of financial market valuations, particularly portfolio flows in the equity and bond markets, subsequently impacting the value of the Malaysian ringgit.

Effective management of expectations for closely monitored economic variables is essential for determining the valuation levels of Malaysian assets in financial markets. Deviations from announced targets can lead to market disappointment and outflows, with foreign outflows particularly affecting ringgit strength, a key component of its valuation. In the context of currency valuation, government initiatives to attract trade and foreign direct investments, coupled with central bank policies addressing foreign exchange volatility, receive significant attention.

To effect a change in the trajectory of financial instruments’ prices in the public markets, macroeconomic achievements must positively surprise the markets or exceed expectations, a core principle applicable across currencies, equities, and bonds, among other financial assets. Therefore, realistic and achievable macroeconomic targets that address key concerns within financial markets are crucial. In Malaysia’s case, simultaneously achieving higher gross domestic product (GDP) growth and fiscal consolidation would be conflicting aims. The 12th Malaysia Plan (12MP) Mid-Term Review’s GDP growth target of 5.0%-6.0%, which significantly surpasses Malaysia’s 20-year average annual GDP growth of 4.7%, underscores the challenges in achieving these goals. As it stands, Malaysia reported an advanced GDP growth estimate of 3.8% in 2023, falling short of the initial target of 4.0%. For 2024, we expect GDP growth of 4.0%-4.5%, compared to the official estimate of 4.0%-5.0%.

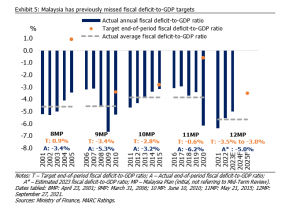

Furthermore, the ambitious target fiscal deficit-to-GDP ratio of 3.0%-3.5% by 2025 under the 12MP (2021-2025) surpasses the 20-year (2003-2022) average fiscal deficit-to-GDP ratio of 4.3% (2021-2022 average: -6.0%), necessitating structural reforms beyond historical norms. A case in point is the 11MP (2016-2020), which targeted a near-balanced fiscal position by 2020, but the actual fiscal deficit was at 6.2% in 2020. Focusing on fiscal consolidation, as suggested by rating agencies, is imperative to mitigate Malaysia’s country risk premium, reducing long-term funding costs, and enhancing valuations of the currency, equities, and bonds.

For a possible positive shift in financial markets and to redirect an underperforming currency and capital market, at least meeting or exceeding stipulated targets is necessary. MARC Ratings’ analysis, as outlined in our press release titled “GST and Other Potential Anchors to Enhance Malaysia’s Fiscal Position” dated October 4, 2023, suggests that a strategic tax policy and the normalisation of the subsidy-to-GDP ratio may reduce Malaysia’s fiscal deficit-to-GDP ratio to slightly over 2%, compared to the 2024 target of 4.3%. Surpassing predefined targets has the potential to strengthen the ringgit, thereby paving the way for heightened foreign engagement in Malaysia’s capital market.

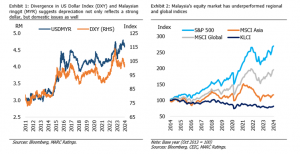

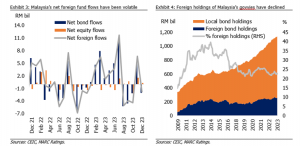

Anchoring domestic targets is crucial given ongoing volatility in the global capital market. Of note, cumulative foreign portfolio inflows of both bonds and equities into Malaysia reached a recent peak of RM30.3 billion in July 2023, but this has tapered down to RM21.8 billion as at December 2023, with a monthly peak of RM11.7 billion in July 2023, compared to outflows of RM1.8 billion in December 2023. The recent retreat in expectations over the pace and extent of future interest rate cuts by developed economies due to their elevated inflation has caused a depreciation in the Malaysian ringgit, from below 4.60 against the US dollar at the beginning of 2024 to the present level exceeding 4.70. Historical inflation in the US has remained persistent, supported by healthy labour markets. Furthermore, the Middle East geopolitical tensions alongside the ongoing Russia-Ukraine conflict may maintain elevated energy and agricultural commodity prices.

Volatilities in the global external sector underscore the importance of a calibrated approach to Malaysia’s domestic national plans, with a focus on pragmatic targets and fiscal rectitude, pivotal for influencing positive market dynamics and fortifying the nation’s economic resilience.