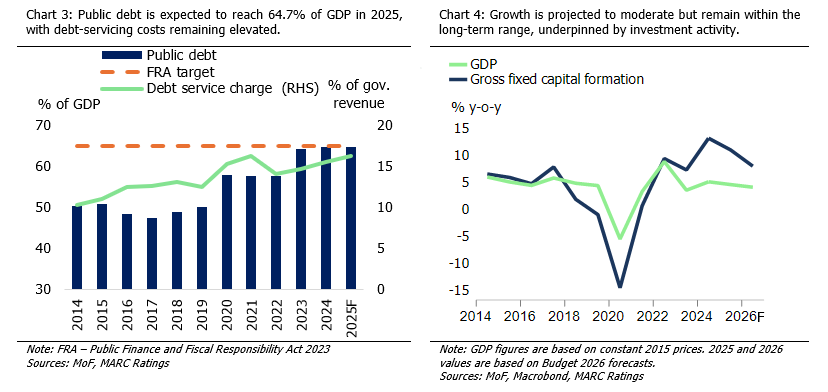

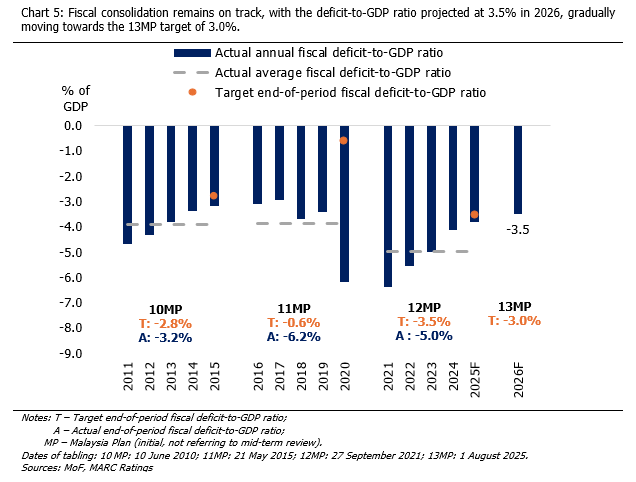

On 10 October 2025, the Malaysian government announced an allocation of RM419.2 billion under Budget 2026, representing 19.7% of gross domestic product (GDP). Of this amount, RM338.2 billion is designated for operating expenditure, whereas RM81.0 billion is allocated for development expenditure. While Budget 2026 has increased slightly from the 2025 revised estimates, it incorporates downward-revised estimates for 2025, reflecting slightly lower allocations for both operating and development expenditure compared with the original Budget 2025 figures. This prudent approach to Budget 2026 facilitates a reduction of the fiscal deficit-to-GDP ratio, which is targeted at 3.5% of GDP in 2026 (2025: 3.8%) and 3.0% in 2028. Nonetheless, on top of the RM419.2 billion allocation, an additional RM50.8 billion of spending will be financed through investments from government-linked investment companies (GLICs), public-private partnerships (PPPs), statutory bodies, and government-linked companies (GLCs).

Budget 2026 underscores the government’s determination to rein in spending and strengthen fiscal sustainability. The fiscal pathway, which includes the reform of subsidies, long identified as a key source of fiscal leakage, continues to underpin this effort. Various subsidy reforms, such as those across certain food items, electricity, and fuel, have yielded further savings. As a result, subsidies and social assistance expenditure is expected to fall by 15.3% to RM57.1 billion in 2025, with a 14.1% decline to RM49.0 billion projected in 2026.

Beyond subsidy cuts, the government is pursuing further efficiency gains within the public sector. Digitalisation of government services is accelerating, supported by the Government Service Efficiency Commitment Act 2025, which aims to trim bureaucratic costs and improve delivery. Complementary reforms, such as the Government Procurement Act 2025 and the proposed Ombudsman Bill, are intended to strengthen governance and accountability. Collectively, these initiatives support the embedding of long-term fiscal discipline.

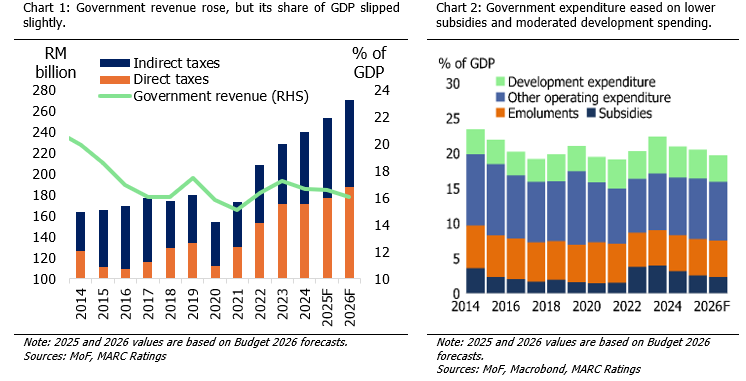

Continuous improvement in tax collection remains a vital pillar of fiscal consolidation. In 2026, the full implementation of e-Invoicing will widen the tax net and strengthen compliance. The initial rollout in 2025 has already yielded strong results, with companies income tax (CITA) collection expected to rise by 4.6%, compared to just 1.1% in 2024. For 2026, CITA revenue is projected to grow by 6.5% to RM103.4 billion, the largest contributor to overall direct taxes, which is expected to rise 5.8% to RM187.4 billion in 2026, an acceleration from prior years. More broadly, e-Invoicing represents a structural reform to Malaysia’s tax ecosystem, by enhancing transparency, reducing leakages, and encouraging voluntary compliance. However, the transition may prove challenging for smaller firms which will likely require implementation support.

Complementing expenditure rationalisation, several revenue-enhancing measures introduced in 2025 will continue to underpin government coffers; these include the expansion of the scope and rate of the Sales and Services Tax (SST), the largest contributor to indirect taxes. While SST collection is expected to grow by 11.6% to RM59.6 billion in 2026, this marks a moderation from 19.4% in 2025 and 26.2% in 2024. The government has also announced a hike in excise duties on tobacco and alcoholic products as well as the introduction of a carbon tax in 2026, targeting the iron, steel, and energy sectors, signalling a gradual move towards a greener, more sustainable economy.

Economic progress in 2026 will be driven by the continuation of national master plans such as the New Industrial Master Plan 2030 (NIMP 2030) and the National Semiconductor Strategy (NSS), both central to Malaysia’s transition to higher-value industries. Budget 2026 also positions Malaysia to become an artificial intelligence (AI) hub by 2030, with initiatives to strengthen digital infrastructure, increase investment in human capital, and accelerate the growth of an AI ecosystem. Achieving these ambitions will, however, hinge on strong private sector buy-in. The Ministry of Finance (MoF) foresees private gross fixed capital formation (GFCF) to grow by 7.9% in 2026, moderating from an estimate of 9.8% in 2025, reflecting cautious optimism amid external headwinds.

Overall, Budget 2026 demonstrates a consistent reform narrative, one that prioritises fiscal prudence and efficiency as well as structural reform. Collectively, these measures not only underpin fiscal sustainability but also strengthen Malaysia’s domestic resilience, by diversifying growth drivers, enhancing self-sufficiency, and reducing exposure to external shocks. As Malaysia enters the first year of the 13th Malaysia Plan (13MP), Budget 2026 lays a credible foundation for GDP growth of 4.0%–4.5% in 2026, ensuring policy continuity while positioning the economy for a more resilient and sustainable future.