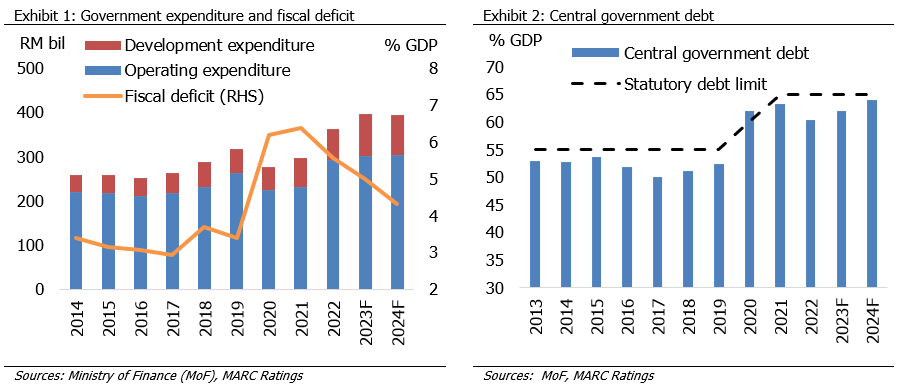

On October 13, 2023, the Malaysian government tabled its Budget for 2024, the largest on record with an allocation of RM393.8 billion (Budget 2023: RM388.1 billion), albeit slightly lower than the spending amount for 2023 estimated at RM397.1 billion. The government has allocated for a higher operating expenditure of RM303.8 billion (2023 estimate: RM300.1 billion), and a lower development expenditure of RM89.2 billion (2023 estimate: RM96.3 billion). However, excluding the RM13.2 billion development fund to retire the 1MDB debt in 2023, development expenditure allocation for 2024 is higher.

The government maintains the fiscal deficit estimate of 5% for 2023 while targeting 4.3% for 2024. This is premised on higher GDP growth, a decelerating pace of operating expenditure and a higher projected Brent price of US$85 per barrel in 2024 (2023 estimate: US$80 per barrel). While we believe the deficit target is achievable, there could be downside risks stemming from lower-than-expected tax collection and weaker growth. These risks can be primarily attributed to the spillover effects of high interest rates in the advanced economies and heightened geopolitical conflicts in the Middle East.

Prior to the budget tabling, significant emphasis was made on the need for Malaysia to raise tax revenue, given the material decline of the tax revenue-to-GDP ratio from 15.3% in 2013 to 11.7% in 2022. In Budget 2024, new tax measures include, among others, an increase in the Sales and Services Tax from 6% to 8%, excluding that for food and beverages as well as telecommunications, a 10% capital gains tax on the disposal of unlisted shares and a high-value goods tax on luxury items. Tax revenue is expected to rise by 6.4% to RM243.6 billion in 2024, which will marginally increase the total revenue by 1.5% to RM307.6 billion. However, bolder measures are required to effectively deepen and broaden the tax base further.

Following targeted electricity subsidies introduced earlier this year, the government plans to further rationalise diesel subsidies and remove price ceilings for selected staple goods. Accelerating overdue reforms would raise confidence in the government’s fiscal health and policies, given Malaysia’s substantial subsidies of an estimated RM67.4 billion in 2022, equivalent to 3.8% of GDP, compared to the 2015–2019 average of 1.9%. These reforms are necessary to mitigate risks to Malaysia’s long-term financial capacity to deliver welfare support required to alleviate cost-of-living pressures on low-income groups. Welfare support accounts for almost 15% of Budget 2024 (2015–2019 average: 9.3%), and will be provided through multiple initiatives such as increased cash handouts, price controls, social protection coverage and housing affordability. Of note, sustaining adequate welfare and public services makes a strong case for the reintroduction of the Goods and Services Tax (GST), which could include exemptions for essential goods and a tiered tax system to reduce the tax burden on low-income individuals.

Owing to the unprecedented borrowings during the pandemic, government debt remains elevated at 62% of GDP as at end-August 2023. This is projected to rise further to 64% of GDP by 2024, close to the statutory debt limit of 65%, partly due to the financing needs of projects under Malaysia’s various national plans. Considering the measures and targets outlined in Budget 2024, international investors, a major source of foreign capital and integral to the ringgit’s prospects, will continue to closely monitor the government’s ongoing fiscal consolidation plans.

The key driver for Malaysia’s 2024 real GDP growth of 4.0%-5.0% (2023 estimate: 4.0%) will be the manufacturing sector, projected to expand by 4.2% (2023: 1.4%). Concurrent with the government’s recent introduction of industrial and economic blueprints, including the Chemical Industry Roadmap 2030, National Energy Transition Roadmap (NETR), and New Industrial Master Plan 2030 (NIMP), Budget 2024 aims to further develop the high-growth and high-value (HGHV) areas of the manufacturing sector amid concerns over premature deindustrialisation. Initiatives such as a tiered reinvestment tax allowance, a visa liberalisation plan for investors, industry recognition for Technical and Vocational Education and Training (TVET) and the development of a new high-tech industrial area for electrical and electronic (E&E) products will facilitate the HGHV aspiration. Over time, it is crucial that the multiple plans remain focused and achievable, to ensure expectations are met. The government’s overarching plans provide valuable direction for the economy but should also aim to reduce coordination and administrative complexities for both the public and private sectors.

Concurrent with its development goals, Malaysia remains committed to boosting real productivity by expanding automation tax incentives, encouraging the substitution of foreign labour with technology, fostering entrepreneurship, advancing human capital in catalytic fields and investing in infrastructure. This commitment extends to RM11.8 billion allocated to flood mitigation projects, as well as various transportation upgrades and specific allocations for tourism in preparation for Visit Malaysia 2026. Contingent upon the execution of development blueprints and committed fiscal policy improvements in due time, Budget 2024 is a progressive step towards achieving quality GDP growth in Malaysia and driving further socioeconomic development amid a challenging period.