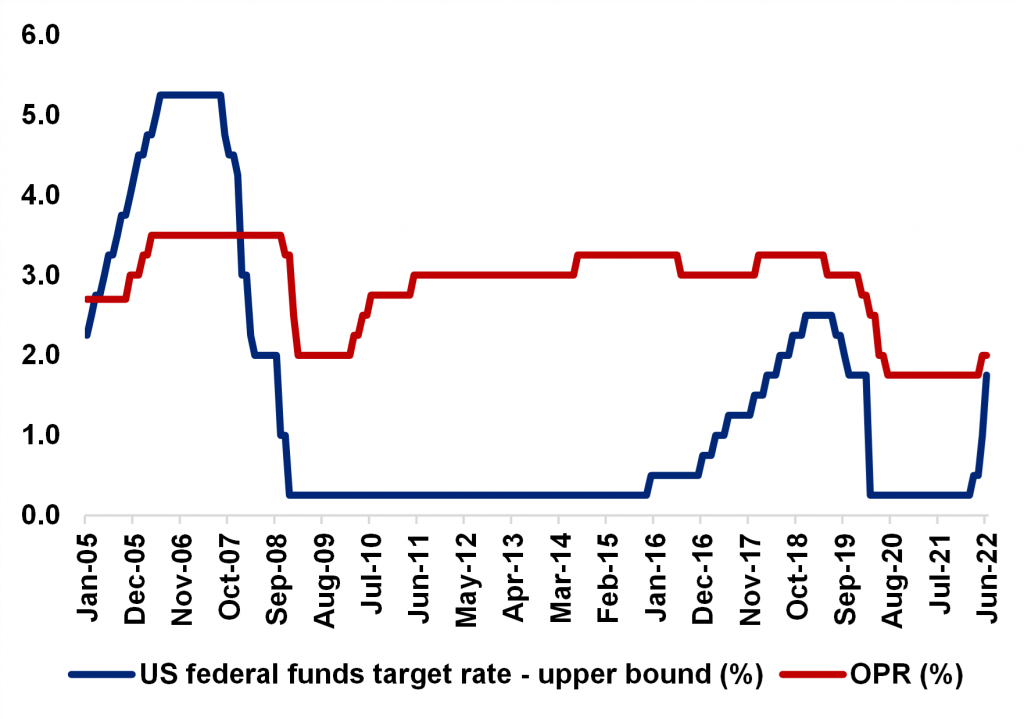

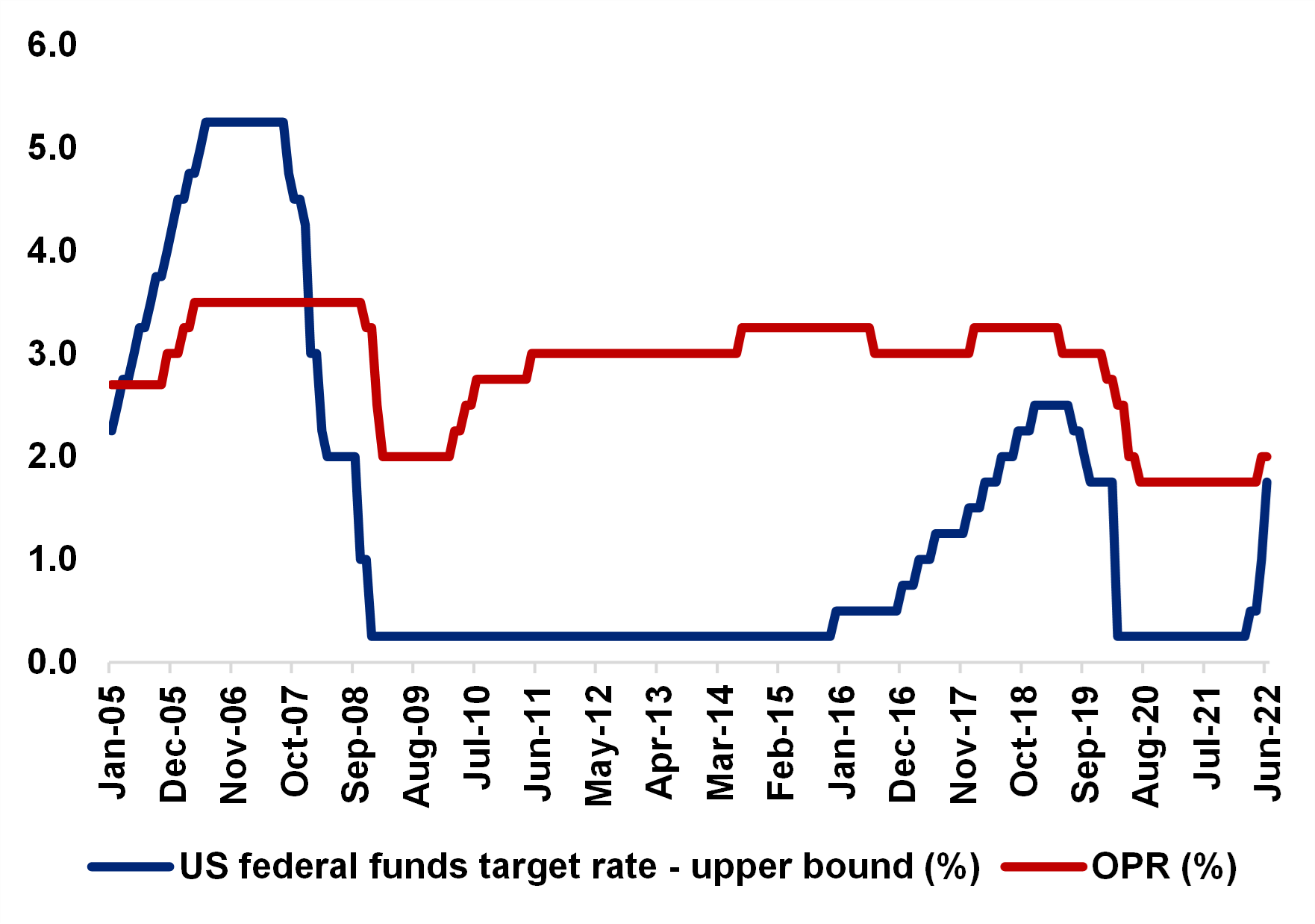

After delivering a 25bps hike in May, the first in more than four years, Bank Negara Malaysia (BNM) followed up with another 25bps increase in the Overnight Policy Rate (OPR) to 2.25% at its Monetary Policy Committee (MPC) meeting on July 6, 2022. The OPR hike had been widely expected as BNM had signalled policy normalisation amid widened rate differential between the US and Malaysia. However, the current OPR remains 75bps below the pre-pandemic level and is still supportive of economic growth, in our view. The real interest rate is still in the negative territory, suggesting ample space for tightening when inflation is no longer transitory.

Growth headwinds emanating from the COVID-19 pandemic have dissipated considerably. However, as the output gap remains negative, the rising borrowing cost calls for higher fiscal support to achieve the official GDP growth estimates of 5.3–6.3%. As it stands, we maintain our 2022 GDP growth forecast at 5.5%.

BNM has retained its relatively sanguine assessment of the domestic economy. The MPC statement cited the upbeat exports and retail spending indicators as well as improving labour market conditions following the reopening of economic sectors, a higher minimum wage, and income support. The central bank also expected the realisation of multi-year projects to support investment activity. This is notwithstanding its words of caution on the moderating external demand that would add to growth risks. That said, a global slowdown will not necessarily lead to a looming recession for Malaysia in the immediate term. This outlook is especially true when China, Malaysia's largest trading partner, is seemingly moving away from its zero-COVID strategy.

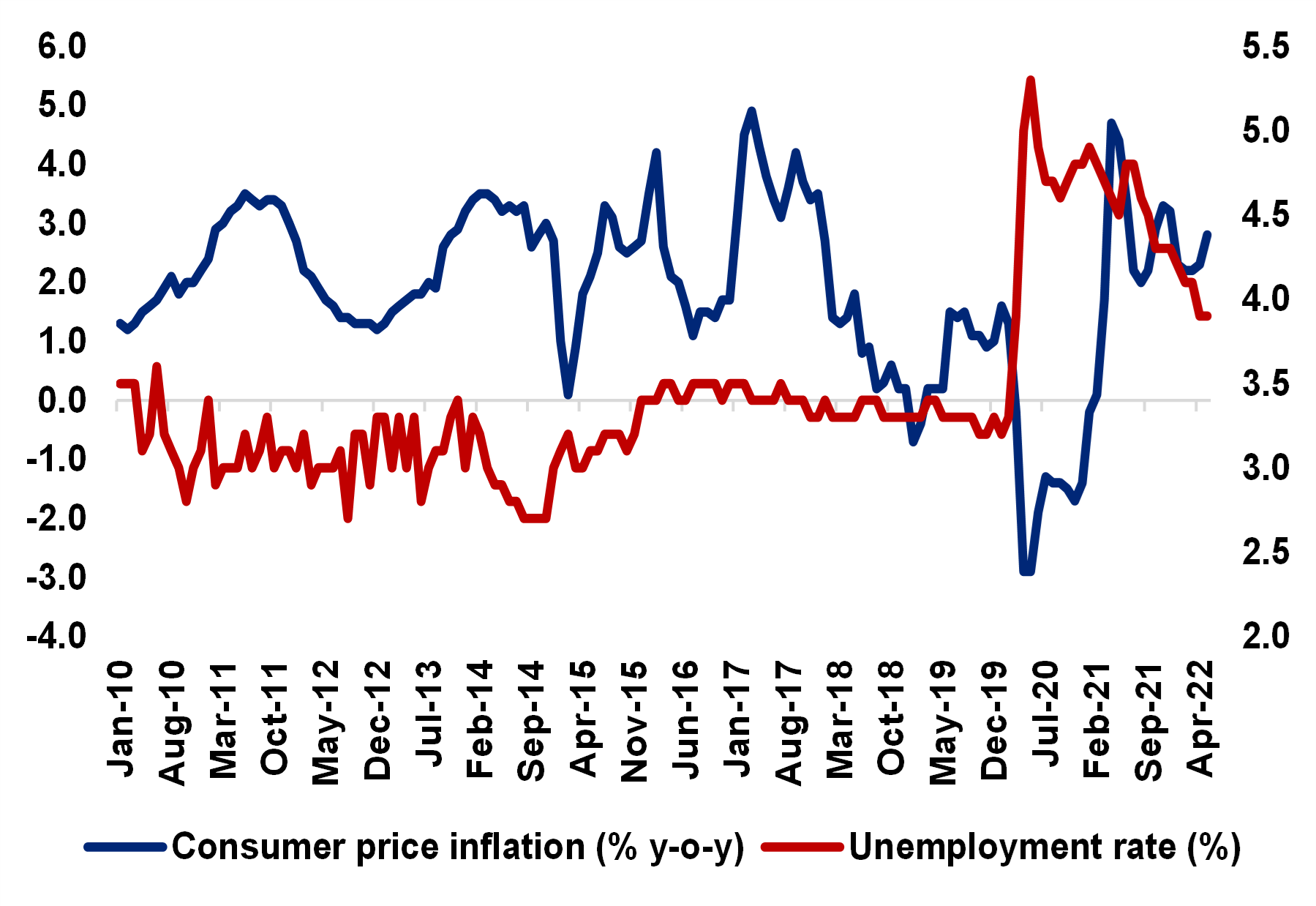

While BNM has maintained its projection for inflation between 2.2% and 3.2% this year, it did note that headline inflation may be higher in some months mainly due to the base effect from electricity prices. We concur with BNM's view and predict inflation to accelerate in the coming months and peak at 4% before easing in late 4Q2022. This is also premised on an additional inflation impulse from the recent increase in ceiling prices and the removal of subsidies for key food items. High price pressure in producer stages, as evidenced by the double-digit growth in producer prices, suggests continued upside risks for inflation.

Prospects of higher interest rates externally, the weakened ringgit and rising inflation risks will keep BNM on a monetary tightening path. However, the pace of the tightening will be gradual and measured as reiterated in the MPC statement, to avoid a severe demand shock. Consequently, so long as the rate gap is a concern, we expect the ongoing consecutive rate hike to continue to 2.75% by year end.

Chart 1: US federal funds target rate and OPR Chart 2: Malaysia consumer price inflation and unemployment rate

Contacts:

Lee Si Xin, +603-2717 2942/ sixin@marc.com.my

Firdaos Rosli, +603-2717 2936/ firdaos@marc.com.my